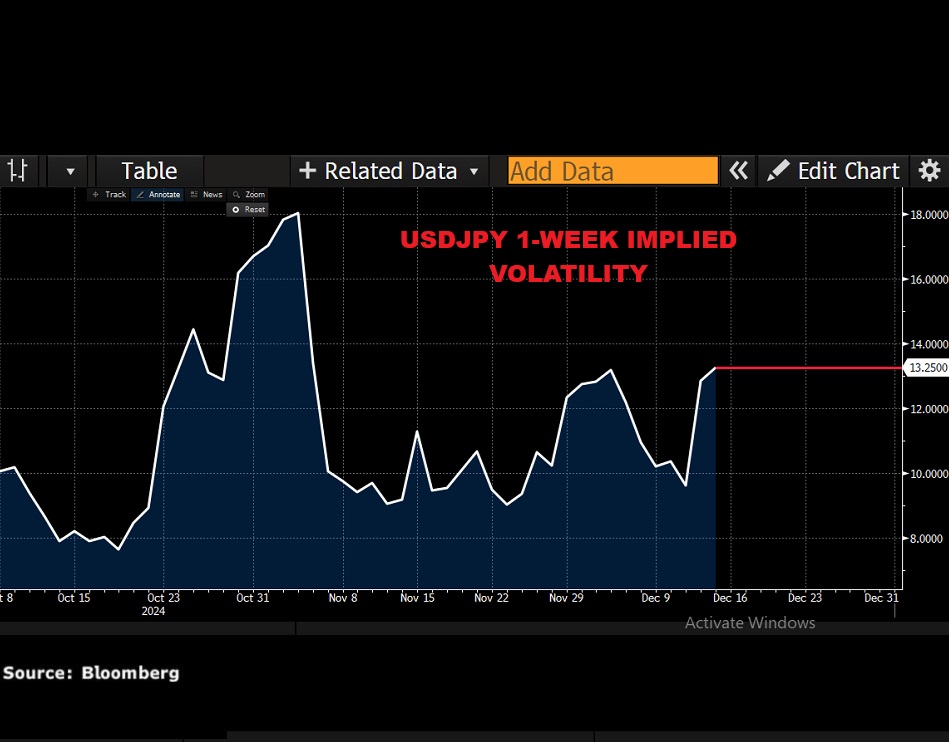

- Yen expected to be most volatile in G10 space vs USD

- Fed seen cutting rates, BoJ to hold rates

- Over past year Fed triggered moves of ↑ 0.5% & ↓ 1.3%

- Over past year BoJ triggered moves of ↑ 1.1% & ↓ 0.7%

- Bloomberg FX model: USDJPY has 72% of trading within 150.49 – 156.11 over 1-week period

Brace yourself!

Major central bank decisions could spark fresh trading opportunities across FX markets.

Our focus falls on the Yen which is expected to be the most volatile G10 currency versus the USD over the next one-week!

The one-week implied volatility for the USDJPY has jumped to its highest level since early November, in the lead-up to the Thursday 19th BoJ meeting.

To be clear, traders are only expecting a 15% probability of a BoJ rate hike. However, any clues or confirmation of future moves could move the Yen.

Rate decisions from the Federal Reserve and Bank of England coupled with high-impact data could make next week one to remember:

Monday, 16th December

- CAD: Canada existing home sales, housing starts

- CN50: China retail sales, property prices, industrial production

- GER40: Germany HCOB Manufacturing and Services PMI, ECB President Christine Lagarde

- JP225: Japan Jibun Bank Manufacturing and Services PMI, tertiary index, machinery orders

- NZD: New Zealand food prices

- UK100: UK S&P Global Manufacturing and Services PMI

- USDInd: US Empire manufacturing index

Tuesday, 17th December

- AU200: Australia consumer confidence

- CAD: Canada CPI

- GER40: Germany IFO business climate, ZEW survey

- SG20: Singapore trade

- UK100: UK jobless claims, unemployment

- US500: US retail sales, industrial production, business inventories

Wednesday, 18th December

- EUR: Eurozone CPI

- GBP: UK CPI

- USDInd: Fed rate decision

Thursday, 19th December

- JPY: BoJ rate decision

- SEK: Sweden rate decision

- TWN: Taiwan rate decision

- GBP: BOE rate decision

- US30: US revised GDP, existing home sales, initial jobless claims, Nike earnings

Friday, 20th December

- CAD: Canada retail sales

- CN50: China loan prime rates

- EU50: Eurozone consumer confidence

- JP225: Japan CPI

- USDInd: US personal income, spending & PCE inflation; University of Michigan consumer sentiment

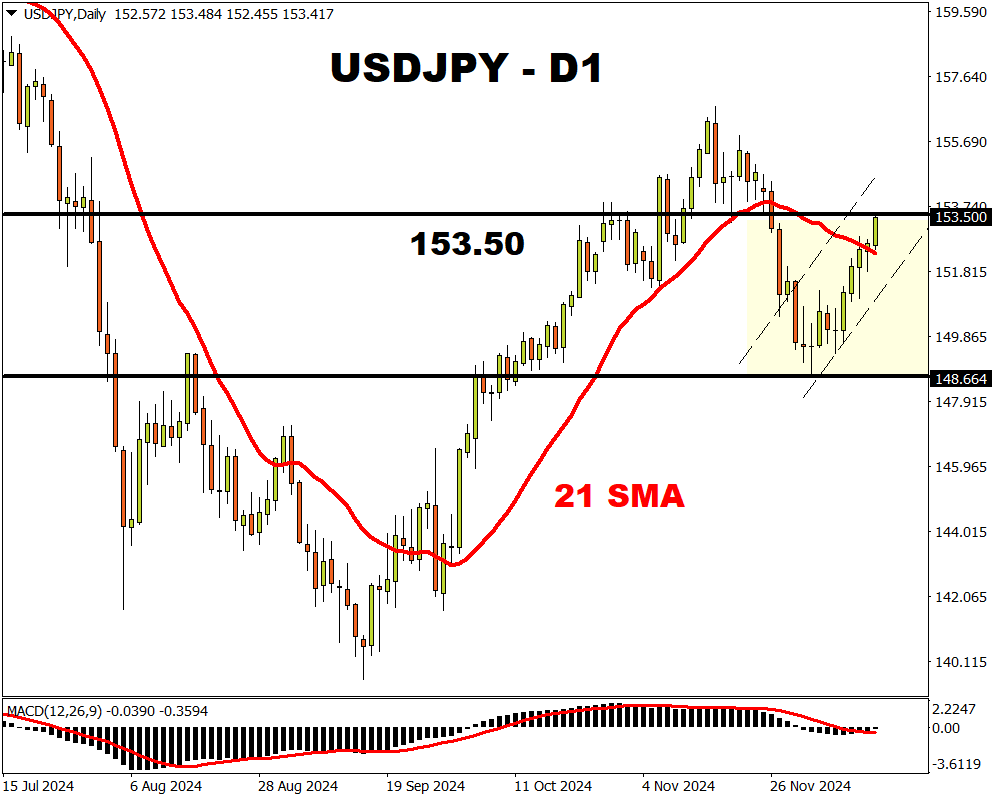

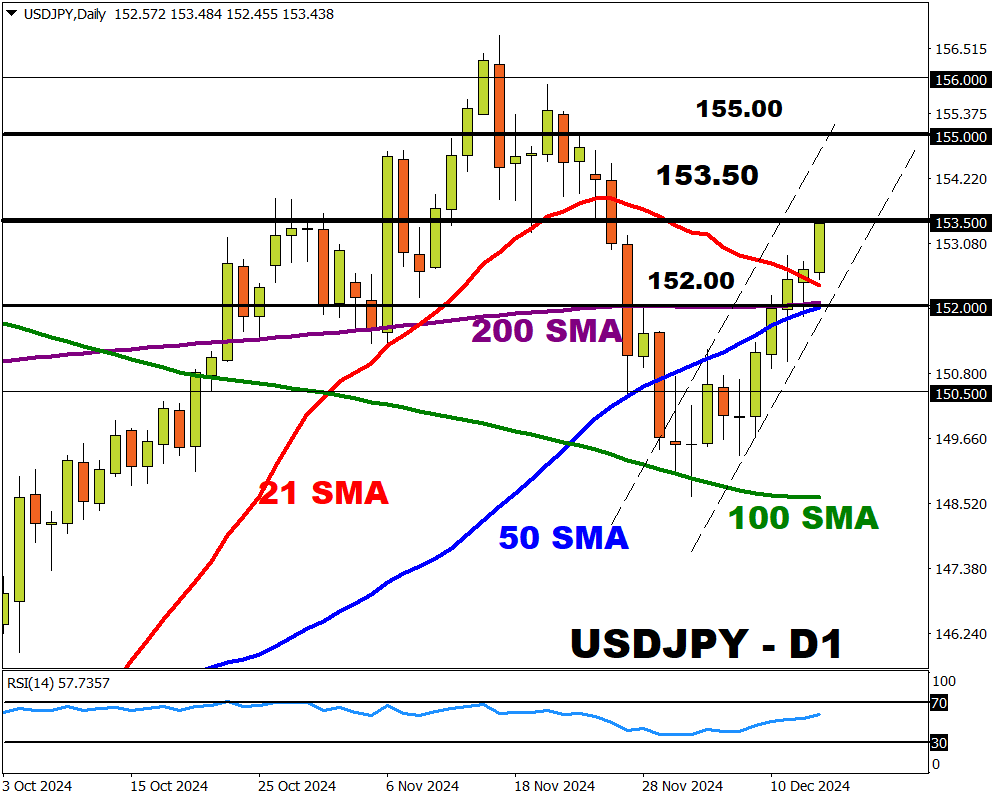

Looking at the charts, the USDJPY is pushing higher on the daily timeframe. The recent break above the 200-day SMA has provided a platform for bulls to challenge 153.50.

A super central bank combo featuring the Federal Reserve and Bank of Japan may ignite significant prices swings in the USDJPY.

Here is what you need to know:

1) Fed rate decision

The Federal Reserve is expected to cut interest rates by 25 bps at its meeting on 18th December.

This is based around a cooling US labour market and recent inflation data matching expectations.

Traders are currently pricing in a 97% probability of a 25-basis point cut by December with the odds of another cut by March 2025 currently at 75%.

Note: Over the past 12 months, the Fed decision has triggered upside moves of as much as 0.5%, or as much as 1.3% in declines in a 6-hour window post-release.

- The USDJPY may slip if the Fed moves ahead with a rate cut and signals further cuts in 2025.

- If the Fed cuts rates but strikes a hawkish note, this may limit the USDJPY’s downside.

2) BoJ rate decision

Markets widely expect the BoJ to leave interest rateS unchanged at its meeting on 19th December.

So, investors will be more concerned with any fresh clues on future policy moves in 2025.

Traders are currently pricing in a 15% probability of a 25-basis point hike by December with the odds jumping to 70% by January 2025.

Note: Over the past 12 months, the BoJ decision has triggered upside moves of as much as 1.1%, or as much as 0.7% in declines in a 6-hour window post-release.

- The USDJPY could tumble if the BoJ signals that rates will be hiked in January 2025.

- Should the central bank sound dovish, the USDJPY is likely to rise as the Yen weakens.

3) Technical forces

The USDJPY has gained over 2% month-to-date with prices trading above the 21, 50, 100 and 200-day SMA. However, the Relative Strength Index (RSI) is approaching overbought territory, suggesting that a technical throwback could be in the making.

- A solid breakout and daily close above 153.50 may open a path toward 155.0. and 156.00.

- Should 153.50 prove to be reliable resistance, this may trigger a selloff back toward the 200-day SMA and 150.50

Bloomberg’s FX model forecasts a 72% chance that USDJPY will trade within the 150.49 – 156.11 range, using current levels as a base, over the next one-week period.