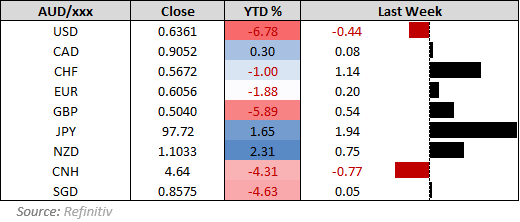

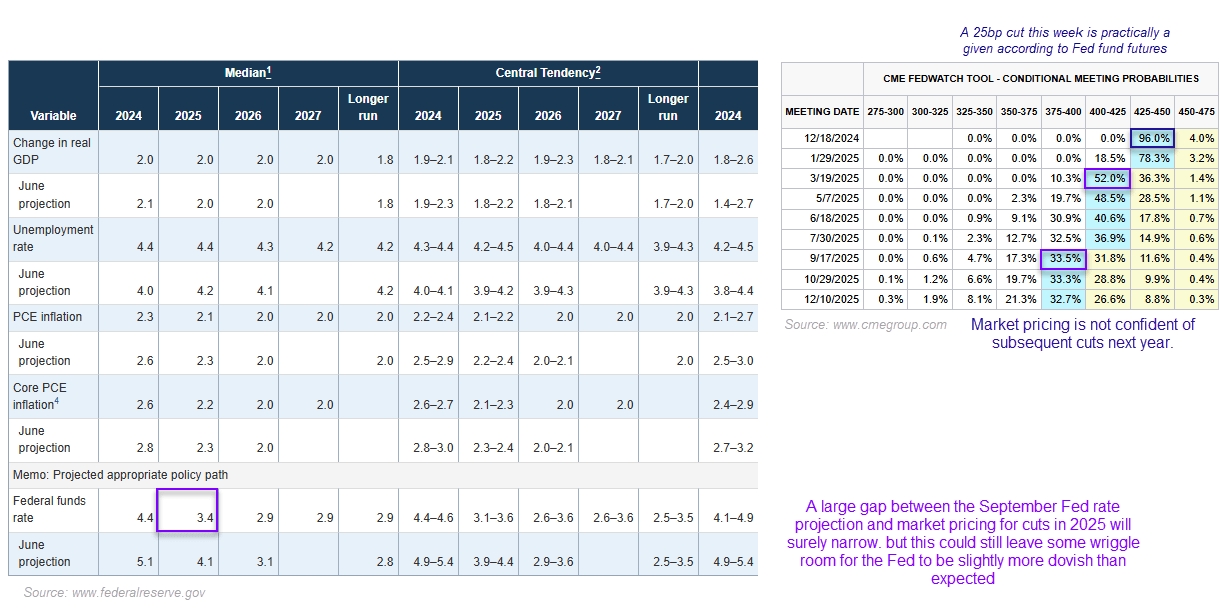

There are five central bank meetings this week (US, Japan, UK, Norway and Sweden), but it will of course be the FOMC meeting that is likely to have the biggest impact on AUD/USD. The consensus is for the Fed to cut by 25bp and hold in January. Fed fund futures are implying a 96% probability of the cut this week, and just 52% chance of a cut in March. From this angle, a surprise would involve the Fed being more dovish than expected.

The Fed will also release their updated staff forecasts, which will be the first opportunity for them to reveal their economic outlook since Trump was elected as President. This no doubt makes things tricky for them as nobody really knows for sure whether his policies will prove to be as inflationary as originally feared, or if some of his cabinet picks will encourage a more cautious approach. For this reason, the Fed’s is likely cling to economic uncertainties as a get out of jail free card.

And with a core PCE inflation rate of 2.7% being above their 2.6% forecast, we could see the 2.2% projection for 2025 upgraded for 2.3% or 2.4%. The median Fed funds projection for 2025 was revised down to 3.4% from 4.1% in June, which is 160bp lower from the current rate of 5%. It’s therefore reasonable to expect this to be upwardly revised, but with Fed fund futures implying low probabilities to even two rate cuts next year there is clearly a large gap to be filled here. So who knows, perhaps the Fed’s meeting could be more dovish than expected anyway, which could result in a weaker US dollar and stronger AUD/USD – from arguably oversold levels.

Attention then shifts to the BOJ meeting, less than 12 hours later on Thursday. Traders have become less confident of a hike, with economists and market pricing now favouring a hold. This makes it less of an event for AUD/USD, but if there are to be any surprises that result in a spike of volatility and therefore risk off, AUD/USD could temporarily get caught in the crosswinds.

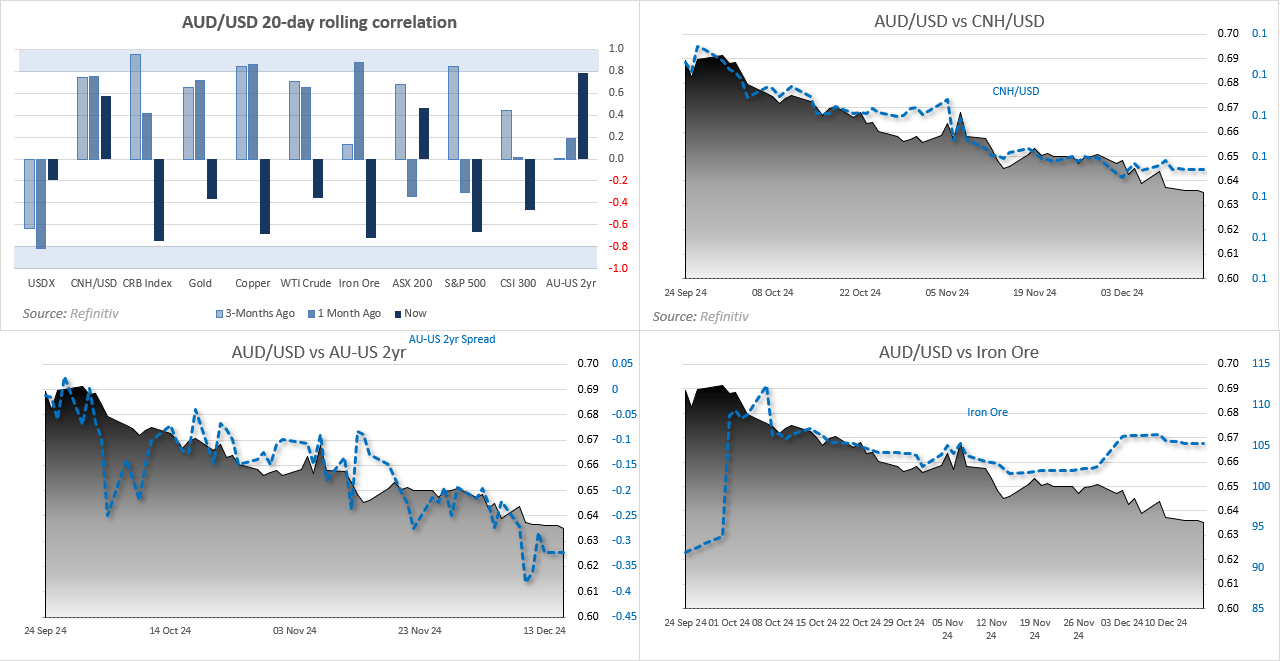

AUD/USD correlations:

- The Chinese yuan remains a key driver for AUD/USD

- Although the yield differential between AU and US has made a comeback, which makes this week’s FOMC meeting the more important

- The correlation between iron and AUD/USD has begun to decouple

AUD/USD technical analysis

The Australian dollar has been mostly ignoring the bullish RSI divergence which has been forming since late October. The divergence has not even dipped into oversold over that time either, and the macro forces which weigh on the Aussie carry more weight than the divergence itself. It also means that should the US dollar continue to strengthen and the yuan weaken, AUD/USD runs the real risk of moving below 63c.

The 10-day SMA is capping as resistance and makes a likely area for bears to reload, unless the Feed deliver a dovish surprise to send AUD/USD higher. And the 20-day SMA is nearby, with the two averages proving a dynamic resistance zone for bears to trade around.

The 1-week implied volatility band has expanded to ~275 pips, with the lower band sitting at 0.6269 on the 2022 and 2023 lows.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge