Weekly Technical Trade Levels on USD Majors, Commodities & Stocks

- Technical setups we are tracking into the weekly open- Fed, BoE, BoJ, US PCE on tap

- Next Weekly Strategy Webinar: Monday, January 6 at 8:30am EST

- Review the latest Video Updates or Stream Live on my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for the US Dollar (DXY), Euro (EUR/USD), British Pound (GBP/USD), Australian Dollar (AUD/USD), Canadian Dollar (USD/CAD), Japanese Yen (USD/JPY), Swiss Franc (USD/CHF), Gold (XAU/USD), Silver (XAG/USD), Crude Oil (WTI), S&P 500 (SPX500), Nasdaq (NDX), and the Dow Jones (DJI). These are the levels that matter on the technical charts into the weekly open / close of the year.

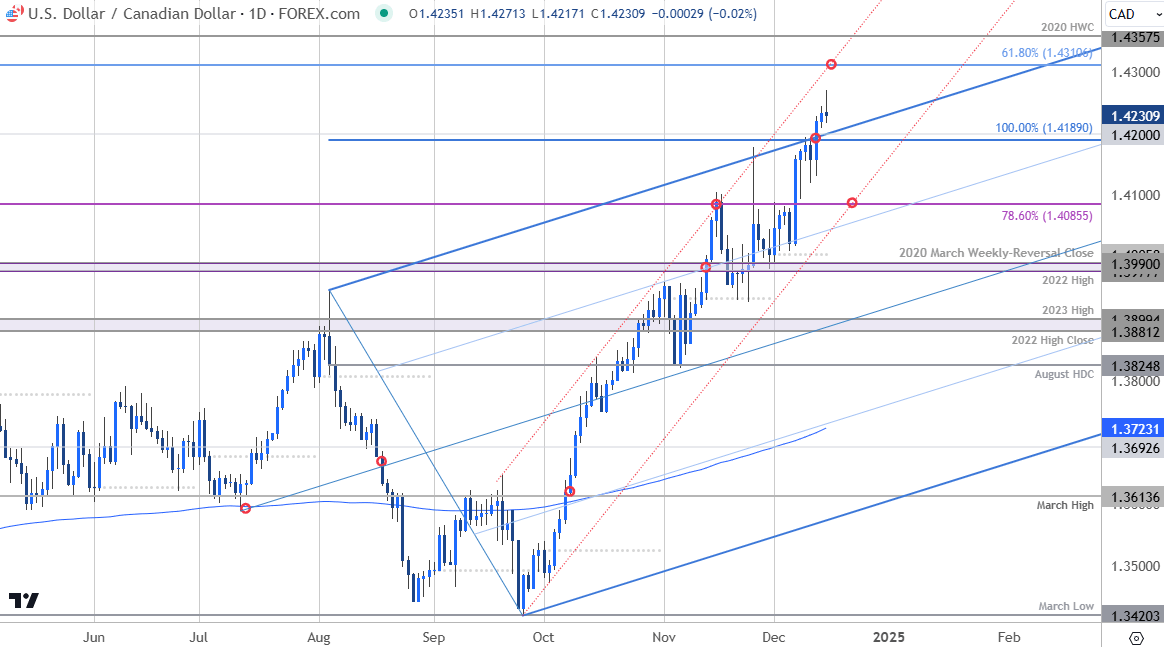

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

USD/CAD broke through confluent uptrend resistance last week with price extending more than 1.9% since the start of the month. The breakout keeps the focus higher while above the 1.42-handle with the next major resistance hurdles eyed at the 61.8% extension of the 2021 advance at 1.4310 and the 2020 high-week close (HWC) at 1.4357. Broader bullish invalidation now raised to 1.4085.

Keep in mind we have the release of key Canadian inflation data tomorrow with the Federal Reserve interest rate decision on tap Wednesday. Stay nimble into the releases and watch the weekly close here for guidance. Review my latest Canadian Dollar Short-term Outlook for a closer look at the USD/CAD technical trade levels.

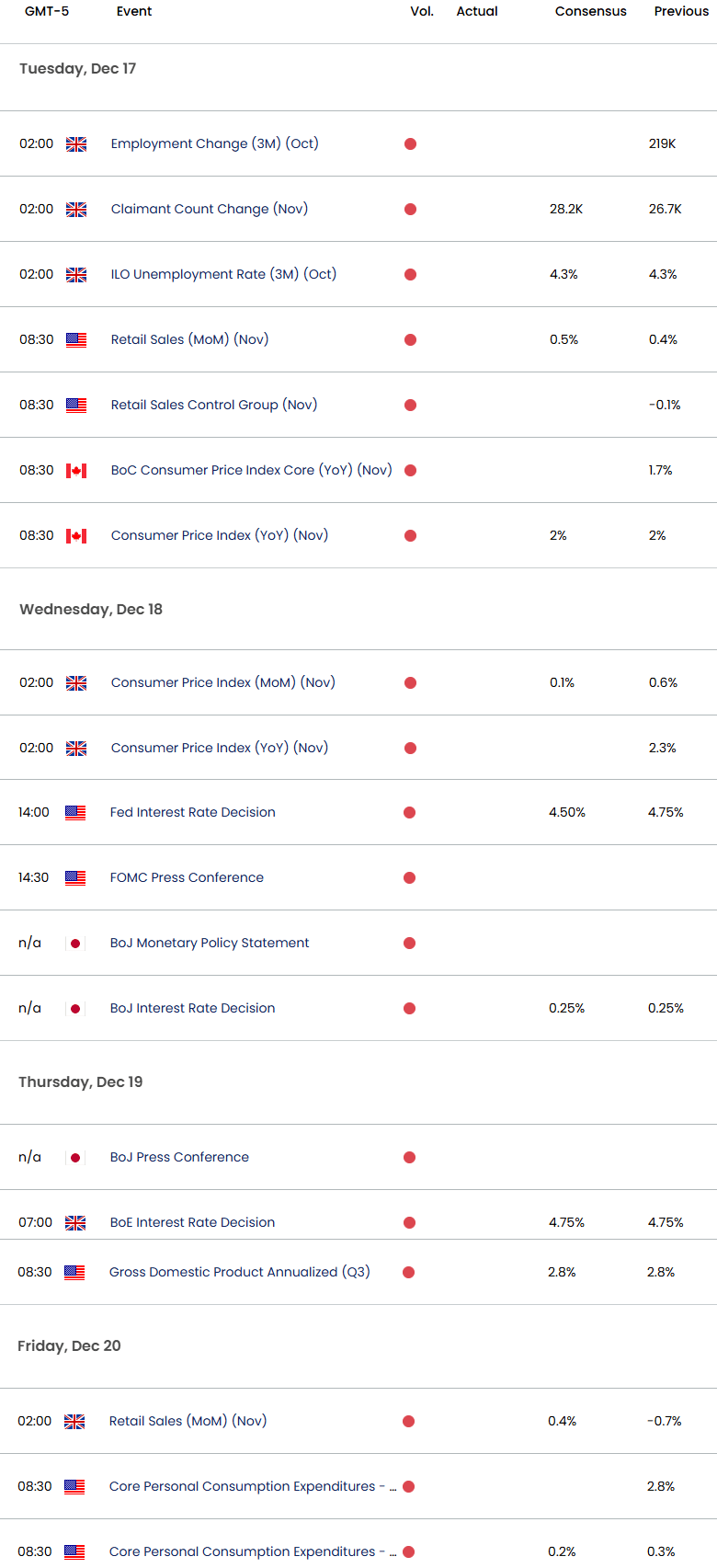

Economic Calendar – Key USD Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex