What is parity in FX?

In forex trading, parity refers to two currencies having equal value. For EUR/USD, this would mean that the EUR/USD exchange rate is 1.00, where one euro is worth exactly one US dollar. While parity is just a number in theory, it often carries significant psychological and economic weight, which could spark a move in the market that trends higher (above parity) or lower (below parity).

Historical chart of EUR/USD with parity highlighted (monthly)

Source: TradingView

Why does parity matter?

Parity is not just a technical level but also a psychological one. It can:

- Influence import/export dynamics between Europe and the US.

- Reflect the relative strength of two of the world’s most important economies.

- Impact global financial markets, given the dollar's status as a reserve currency and the euro’s role in international trade.

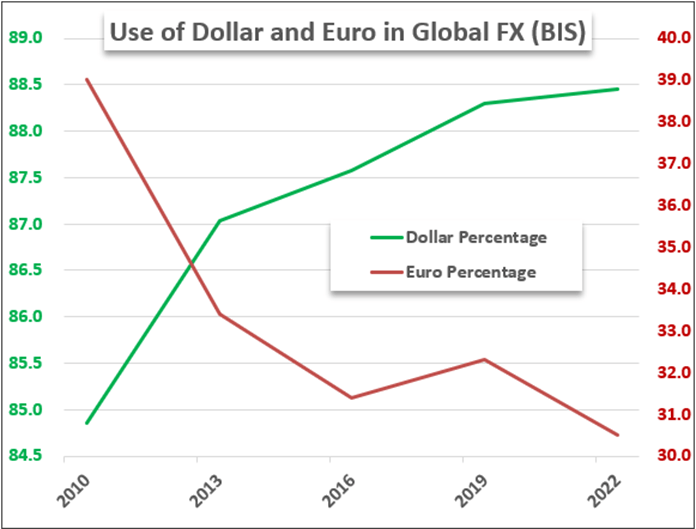

Chart of global percentage use of dollar and euro (excluding all others)

Source: Bank for International Settlements Triennial Report

As EURUSD flirts with parity, understanding its implications is crucial for traders, investors, and policymakers. The currency pair serves as a snapshot of global economic conditions, reflecting the interplay of central bank policies, market sentiment, and geopolitical shifts. Whether EUR/USD stays above, dips below, or hovers around parity, this threshold plays a significant role when it comes to the perception of the overall FX market, and informs investment strategies accordingly.

A brief history of EUR/USD parity

Historically, EURUSD has crossed parity during periods of major economic shifts. Let’s take a look at what has happened in the past:

The launch of the euro (1999)

The euro was introduced in 1999, replacing a basket of European currencies. Initially, the EUR/USD exchange rate started around 1.17 but quickly declined below parity due to skepticism about the euro's strength and the Eurozone's economic cohesion.

A decline below parity (2000-2002)

By late 2000, EUR/USD fell to a historic low of 0.8230 as investors favored the stronger US economy and dollar. Concerns over the Eurozone's economic growth weighed on the euro.

Rise above parity (2002)

The euro regained parity in mid-2002, driven by improving Eurozone economic data and waning confidence in the US dollar due to geopolitical risks and the aftermath of the dot-com bubble.

Bull market for the euro (2003-2008)

The euro climbed to historic highs of over 1.60 by 2008, fueled by a weaker US dollar during the Global Financial Crisis (GFC) and a growing belief in the euro as a viable alternative reserve currency.

Fluctuations post-crisis

Since the GFC, the EUR/USD has seen periods of strength and weakness, influenced by Eurozone sovereign debt crises, US Federal Reserve policy changes, and other global economic factors.

Parity in recent years (2022)

For a couple of months in late 2022, EUR/USD fell back below parity for the first time in two decades due to a combination of aggressive Federal Reserve rate hikes, the economic impact of the Russia-Ukraine conflict on Europe, and surging energy prices that threatened Eurozone growth.

How could Trump’s victory affect the potential EUR/USD parity?

Since Donald Trump’s decisive win in the November 5 election, which also secured Republican control of both chambers of Congress, the U.S. dollar index, which tracks the dollar’s performance against a basket of major currencies, has surged to its highest point in a year.

The potential for sweeping new tariffs under President-elect Trump has some economists forecasting a return to parity between the euro and the U.S. dollar. Trump’s fiscal policies could drive domestic inflation, prompting the Federal Reserve to take a more cautious approach to monetary easing. Meanwhile, the threat of renewed and increased tariffs from the incoming Trump administration may further weigh on the Eurozone economy and increase the pressure on the ECB to extend rate cuts.

A sluggish eurozone economic outlook, coupled with rising geopolitical tensions in Russia, is also expected to put further pressure on the euro.

So is EUR/USD parity on the way?

According to Matt Weller, CFA, Head of Market Research for FOREX.com, traders are starting to look at EUR/USD parity in 2025 as the Eurozone structural issues collide with the narrative of US economic exceptionalism, which is basically the view that the US economy is structurally more robust and resilient than its developed world peers.

Central banks are still the main drivers of exchange rates however, and current expectations are for a widening interest rate gap between the US and Europe. The ECB is expected to cut rates sharply from 3.25% to 1.8% in the next 12 months as Germany and France face political turmoil. Meanwhile, Weller expects the Fed to cut rates more slowly with only a few small cuts and US rates to remain around 4%.

The interest rate gap is expected to widen from 1.25% to 2% in the next 12 months and could push the EUR/USD lower. But it all depends on the data: inflation and a strong US labor market could support the dollar, while Eurozone data will force the ECB to ease more – and push EUR/USD to parity.

How to trade EUR/USD parity

Source: TradingView, StoneX

EUR/USD is threatening to break down from the 1.0500-1.1200 range that has kept prices contained since the start of 2013. From a technical perspective, Weller sees two probable scenarios.

After a nearly 2-year sideways consolidation, a strong directional thrust is possible if the breakdown is confirmed. In that scenario, a continuation toward at least 1.02, if not outright parity (1.00) could be in the cards as we flip the calendars to 2025.

On the other hand, a bullish reversal and “false breakdown” scenario could lead to a snapback rally toward the middle of the range in the 1.07-1.08 zone as aggressive shorts get squeezed. One way or another, we’ll soon know whether EUR/USD parity is an imminent possibility.