- NZD/USD pressured by NZ recession and strong US growth

- Signs of recovery with better data and dairy price rebound

- Technical patterns hint at potential Kiwi bottom

- Fed rate outlook likely to drive next big move

Summary

The NZD/USD has been under pressure in 2024, reflecting New Zealand's recession, China’s economic woes, and the robust performance of the US economy which has tempered expectations for Fed rate cuts. However, recent data, including an improvement in New Zealand's services sector and a rebound in dairy prices, signals the Kiwi may be nearing its nadir. Technical indicators such as a three-candle morning star and falling wedge pattern on the daily chart suggest a potential near-term bottom, though momentum signals are yet to confirm.

Attention now shifts to the Fed’s FOMC rate decision, where signals on the path of US interest rates and the neutral rate projection will dictate broader market moves. A dovish shift could boost NZD/USD while a hawkish outcome risks renewed downside.

Kiwi crunch comes as no surprise

It’s been to dunk on NZD/USD recently. New Zealand is a small economy in recession with its largest trading partner, China, struggling even before the tariff threat from Trump administration is considered. Simultaneously, the United States is rollicking along, limiting the decline inflation and capping unemployment, resulting in a big recalibration of expected scale of rate cuts we’ll see from the Federal Reserve. It’s little wonder the Kiwi, nicknamed the 'flightless bird' among some traders, has been grounded in 2024.

However, they are known knowns. And while nobody should expect a deviation from the prevailing trend near-term, it may require a continued divergence between the United States and New Zealand to see the Kiwi sink further. Because if that doesn’t happen, any indicator that suggests performance is converging could easily spark a short squeeze considering how far NZD/USD has fallen.

New Zealand nears turning point?

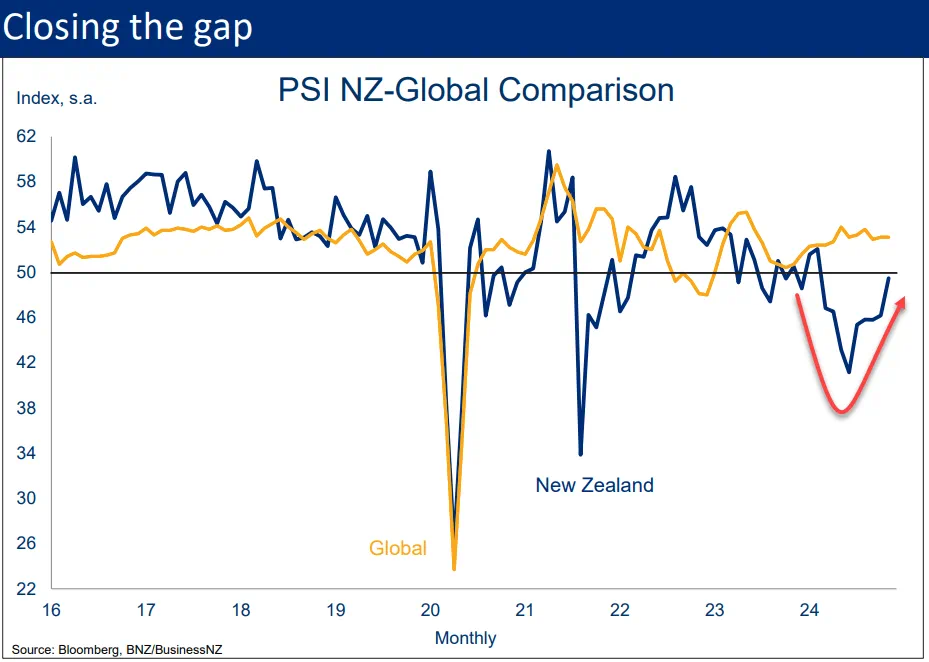

It didn’t receive a lot of attention on Monday, but the Bank of New Zealand Performance of Services Index (PSI) was one such indicator. While still indicating a decline in activity in November with a reading of 49.5, that was up from 46.2 in October. More importantly, however, it saw relative service sector performance in New Zealand compared to other developed economies close sharply.

Source: BNZ

Throw in a strong rebound in dairy prices recently, New Zealand’s most valuable export item, and you can’t help but see flickering signs the economy may be through the worst of the economic pain. Even with a very strong S&P Global flash services PMI report for the United States in December, it’s noteworthy the NZD/USD was among the top performing FX pairs during Monday’s session.

Perhaps the bearish Kiwi tide may be starting to turn?

NZD/USD directional risks shifting higher?

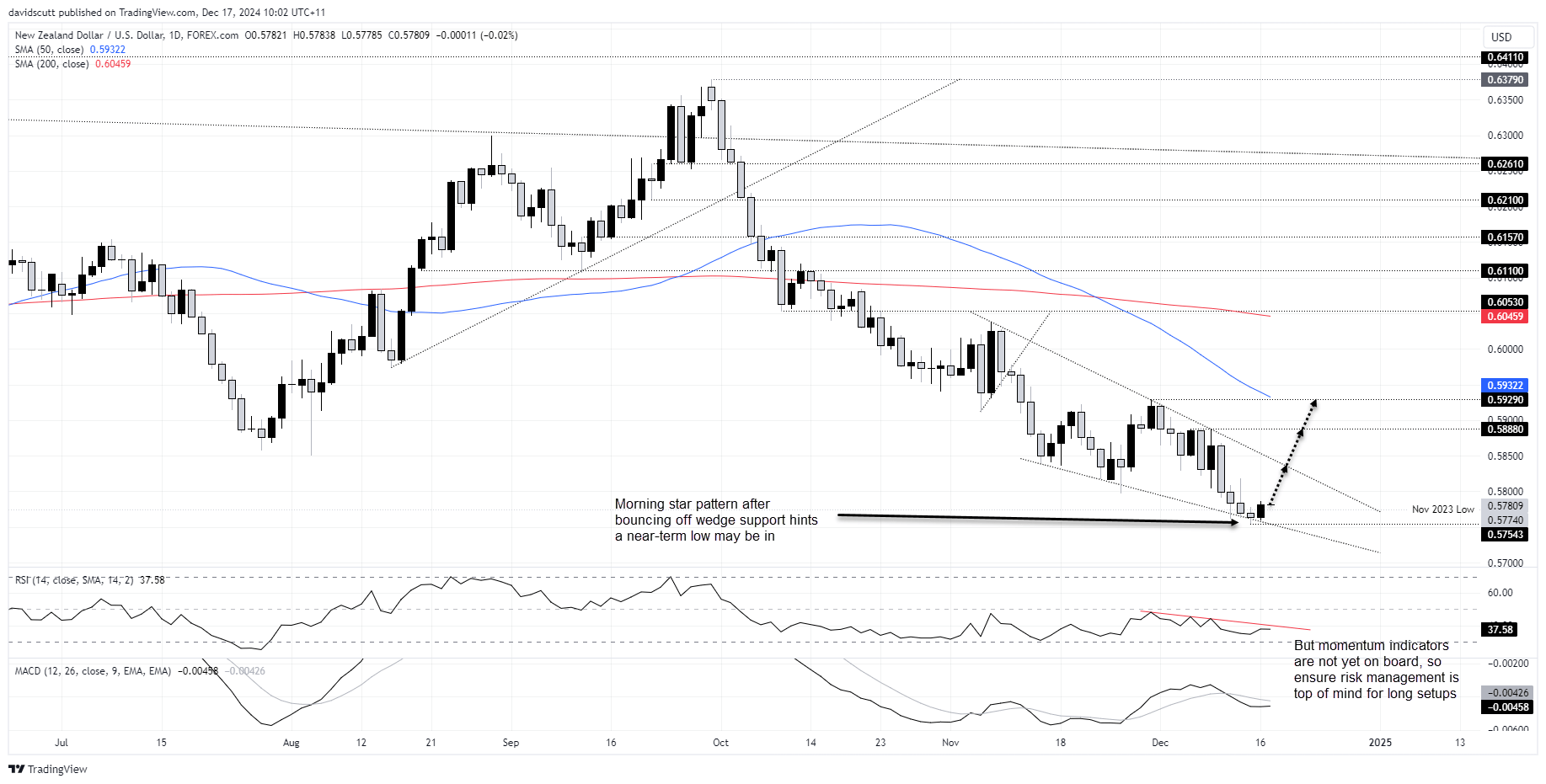

Source: TradingView

NZD/USD completed three-candle a morning star on the daily timeframe on Monday, a pattern often seen around market bottoms. Sitting in what looks to be a falling wedge, the bounce from support after a failed downside break on Friday bolsters conviction that a near-term bottom may be in. However, with RSI (14) and MACD generating bearish signals on momentum, anyone considering longs should ensure capital protection is at the forefront of their thinking around potential setups.

With the completion of the morning star, one idea would be to buy around these levels with a stop beneath Friday’s low for protection. The reversal last Thursday following a failed probe above .5800 means that level looms as an nearby hurdle longs will need to overcome to make the setup stack up from a risk-reward perspective.

If NZD/USD can push and hold above .6200, wedge resistance around .5850 is one potential trade target. If that were to be broken, .5888 and .5929 would quickly come on the radar. If the price were to reverse and take out Friday’s lows, the near-term bullish bias would be invalidated.

Fed rate outlook key to setup success

The Federal Reserve FOMC rate decision is the key event not only for NZD/USD but broader markets this week. A lot of things are said and written about the Fed, but what really matters at this meeting is what the committee signals on the path of interest rates moving forward, not the actual rate decision. A 25bps cut is deemed a lock, so ignore the noise around it.

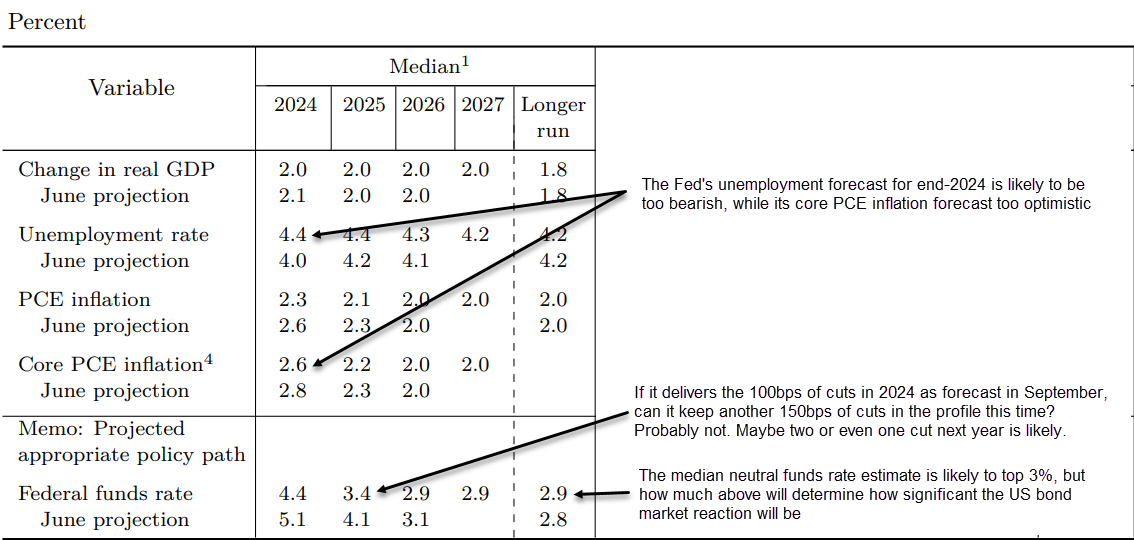

Source: Federal Reserve

Markets are pricing two cuts from the Fed in 2025, half the number expected by the FOMC members three months ago. While that’s what I believe the Fed will signal, for this trade setup, three or more cuts would likely spark a rally in the Kiwi. Conversely, if only one cut, the US dollar would likely surge.

The other area to watch is the long-run dot, which is essentially where the FOMC thinks the neutral level for the Fed funds rate is. This theoretical level is important when it come to market reaction. Three months ago, the Fed pinned it at 2.9%. On this occasion, an increase is likely. 3% should spark relief from risker asset classes, but anything 3.2% or more implies a higher for longer interest rate outlook which would help feed USD strength.

-- Written by David Scutt

Follow David on Twitter @scutty