US Dollar Outlook: AUD/USD

AUD/USD approaches the November 2023 low (0.6318) as it gives back the advance from the start of the week, but the Federal Reserve interest rate decision may sway the exchange rate as the central bank is anticipated to further unwind its restrictive policy.

US Dollar Forecast: AUD/USD Approaches November 2023 Low

AUD/USD slips to a fresh monthly low (0.6333) as it starts to carve a series of lower highs and lows, and the exchange rate may track the negative slope in the 50-Day SMA (0.6545) as it holds below the moving average.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

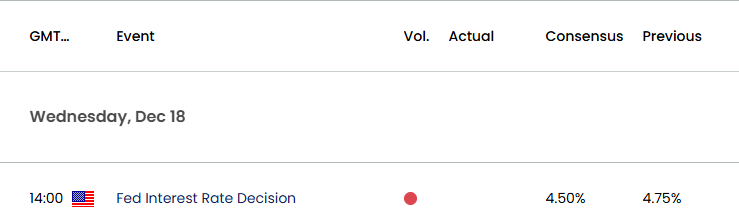

US Economic Calendar

Nevertheless, the Federal Open Market Committee (FOMC) is expected to reduce US interest rates by another 25bp at its last meeting for 2024, and the Fed may continue to pursue a neutral stance in 2025 as the central bank acknowledges that ‘the unemployment rate is notably higher than it was a year ago.’

In turn, more of the same from the FOMC may produce headwinds for the Greenback as the central bank continues to change gears, but the updated forecasts from Chairman Jerome Powell and Co. may keep AUD/USD under pressure should the Fed show a greater willingness to unwind its restrictive policy at a slower pace.

With that said, a hawkish Fed rate-cut may fuel the recent decline in AUD/USD, but lack of momentum to test the November 2023 low (0.6318) may curb the bearish prices series in the exchange rate.

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD falls toward the November 2023 low (0.6318) as it trades to a fresh monthly low (0.6333), with a breach below the 2023 low (0.6270) opening up 0.6240 (61.8% Fibonacci extension).

- Next area of interest comes in around 0.6130 (23.6% Fibonacci retracement), but AUD/USD may snap the recent series of lower highs and lows should it struggle to test the November 2023 low (0.6318).

- Need a close back above the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) zone to bring the monthly high (0.6515) on the radar, with a break/close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) region bring the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) area on the radar.

Additional Market Outlooks

USD/CAD Pullback Keeps RSI Below Overbought Territory

US Dollar Forecast: EUR/USD Attempts to Halt Five-Day Selloff

USD/JPY Stages Five-Day Rally for First Time Since June

Gold Price Forecast: Bullion Remains Below Pre-US Election Prices

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong