A decent bullish reversal candle has formed on the ASX 200 on Tuesday, which begs the question as to whether Santa’s rally is about to kick into gear. Were it not for the pending FOMC meeting in just under 24 hours, I’d lean towards yes. But the Fed may need to deliver a set of considerably-less dovish projections compared with their September’s outlook to see risk rally tomorrow.

If they revise their 2025 cuts to one or even none, the ASX could retest and even break below the 8200 downside target I mentioned yesterday.

But I think there is a chance that the Fed won’t be as hawkish are expecting, mainly to save face. The 25bp cut is practically a given, so if they still suggest at least two cuts are arriving next year then it could help risk bounce in line its seasonal tendency from tomorrow. Whereas a relatively hawkish meeting could see as final drive lower for the ASX before the late-December rally kicks into gear next week.

Ultimately, I believe we are in for a Santa’s rally. But the Fed meeting could decide whether it begins on Thursday or next week.

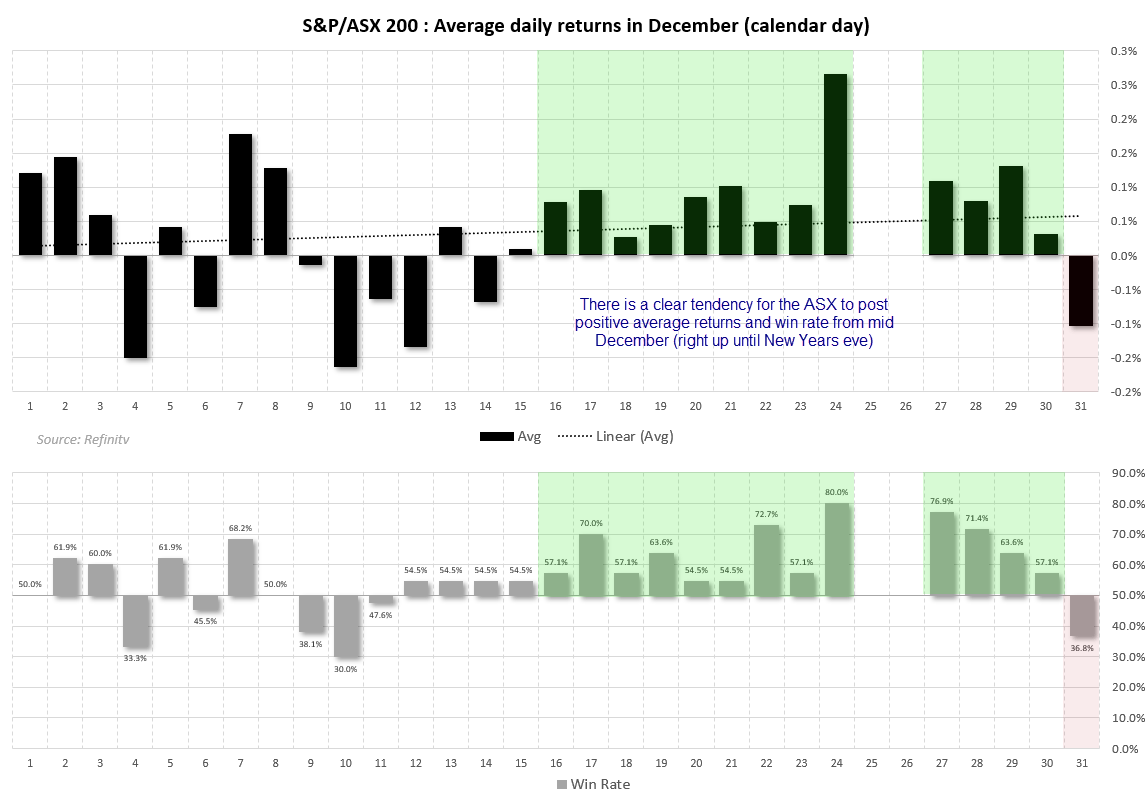

ASX 200 seasonality for December

Average daily returns for the ASX 200 in December show a clear bullish bias from the middle of the month. In fact, the ASX delivers positive average returns alongside a positive win rate (bullish days greater than 50% of the time) for each trading day between December 16th to 30th. Traders then tend to book profits and generate a negative average return and win rate (it closes the day lower over 50% of the time on 31st December).

ASX 200 futures (SPI 200) technical analysis:

A prominent bullish engulfing candle formed on Tuesday to hint at a swing low. But as suggested above, it is likely down to whether the Fed hint at 1 or fewer cuts next year as to whether it will dip lower. Because if they signal 2 or more cuts, then risk could rally after the close.

Regardless, seasonality suggests risk could rally next week once the FOMC dust has settled.

The daily RSI reached the extremely oversold level of zero before popping higher, so perhaps the low has already been seen. A slight bearish divergence formed on the 1-hour chart beneath the weekly R1 pivot and prices are retracing lower. The bias is to seek dips within yesterday’s range in anticipation of a break of Tuesday’s high and Santa’s really ensue. 8450 seems a reasonable target for low-liquidity, end of year conditions. Of course, take note of the tendency for the ASX to selloff on the final day of the month (which lands a week on Tuesday).

Economic events in focus (AEDT)

- 10:50 – JP trade balance

- 11:00 – AU leading indicator

- 18:00 – UK CPI, PPI

- 21:00 – EU CPI, construction output

- 06:00 – Fed interest rate decision

- 06:30 – FOMC press conference

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge