- US500 ↑ 23% year-to-date

- December: Produced returns 70% of time since 1995

- Gained on average 1% in December over past 30 years

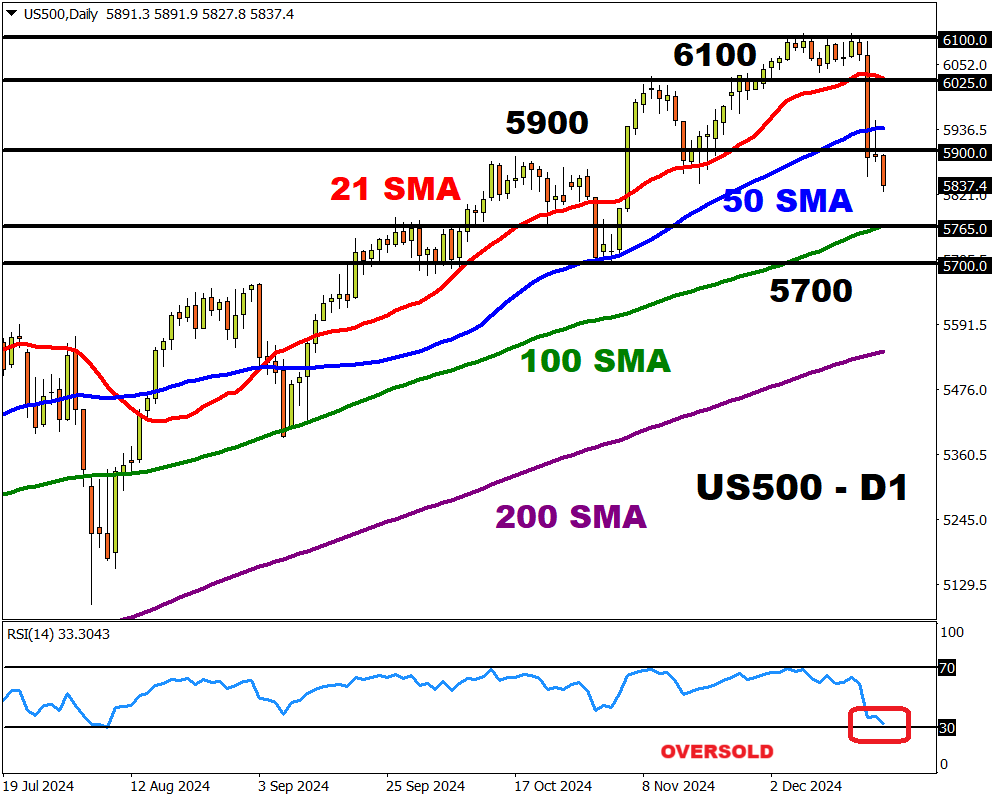

- Prices bearish on D1 but RSI oversold

- Technical levels: 21-Day SMA,5900 & 100-day SMA

FXTM’s US500, which tracks the benchmark S&P 500 index is on track for its worst trading week since September.

But bulls could make a return if the “Santa Claus rally” kicks off in the week ahead:

Saturday, 21st December

- Deadline for avoiding partial US government shutdown

- CN50: China’s National People's Congress standing committee

Monday, 23rd December

- SG20: Singapore CPI

- TWN: Taiwan industrial production, jobless rate

- GBP: UK GDP (final)

- USDInd: US Conference Board consumer confidence

Tuesday, 24th December

- AU200: RBA meeting minutes

- JP225: BoJ meeting minutes

Wednesday, 25th December

- Stock markets closed - Christmas Day

Thursday, 26th December

- Boxing Day Holiday

- SG20: Singapore industrial production

- US500: US initial jobless claims

Friday, 27th December

- JP225: Japan Tokyo CPI, unemployment, industrial production, retail sales

The lowdown…

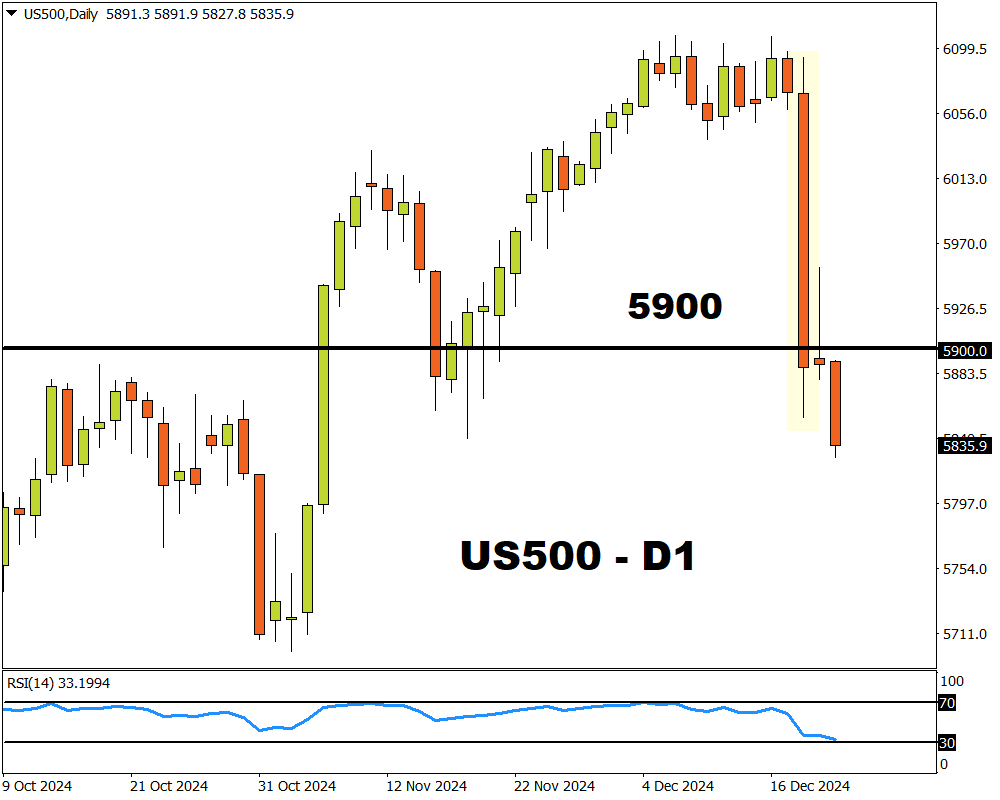

US equities tumbled on Wednesday following the Fed’s hawkish pivot.

Interest rates were cut as widely expected but the Fed signalled a slower pace of easing in 2025.

Traders are now only pricing in a 54% probability of a 25 basis point Fed cut by March 2025 with this jumping to 75% by May 2025.

This sent the US500 tumbling 3%, dragging prices below 5900 for the first time since mid-November.

US equity bears are back in the scene with the threat of a potential partial US government shutdown weighing on sentiment.

The question is whether the latest developments have reduced the chance of a Santa rally?

What is the Santa rally?

This financial phenomenon is where stocks generally gain in the last week of December and the first two trading days of the new year.

It’s unclear whether this is fueled by psychology or triggered by underlying financial forces.

Nevertheless, history has shown that this is a recurring seasonal pattern.

Indeed, December has been a historically positive month for the S&P500 which has produced positive returns 70% of the time since 1995.

On average, over the past 30 years the S&P 500 has delivered returns of 1% in December.

The bigger picture…

The US500 is up 23% year-to-date – its second straight year of returns above 20%.

It has notched 57 record highs thanks to the AI mania, Fed rate cuts and Trump’s election win.

A Santa Clause rally could push prices back toward the psychological 6000 level, paving a path back to 6100 and higher.

Technical forces

The sharp selloff last Wednesday has placed bears in a position of power. Prices are trading below the 21 and 50-day SMA but the Relative Strength Index (RSI) is near oversold levels.

- Sustained weakness below 5900 may encourage a decline toward the 100-day SMA and 5700.

- A move back above 5900 could trigger an incline toward 21-day SMA and 6100.