This is an excerpt from our full 2025 AUD/USD Outlook report, one of nine detailed reports about what to expect in the coming year.

The RBA, Fed and converging rate differentials

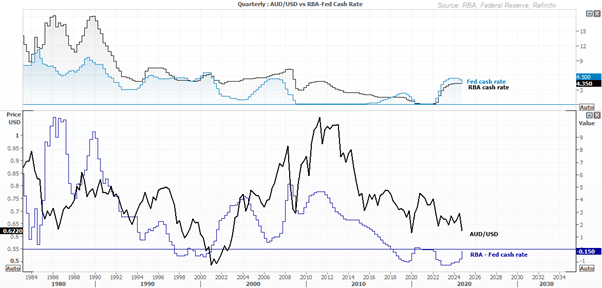

The Federal Reserve’s easing cycle has seen the RBA-Fed interest rate differential narrow to just -15bp, as suggested in the 2024 outlook reports. Usually, this would be a bullish signal for AUD/USD, but the game has since changed. And quite considerably.

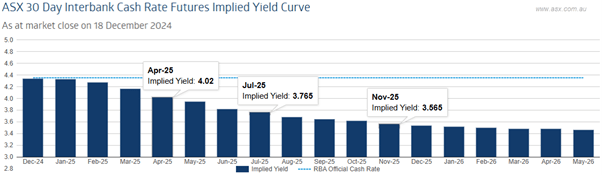

Renewed expectations of RBA cuts

Weak Q3 growth figures for Australia revived bets of RBA cuts in 2025. The RBA cash rate futures curve has fully priced in 25bp to land in April, June and November. The anticipated -75bp of cuts would then see the RBA’s cash rate lowered from 4.35% to 3.6%. Incoming data for January will likely decide whether markets will bring forward that first cut to Q1, most notable of which will be the quarterly CPI figures in late January followed by incoming employment figures.

Source: RBA

Fewer cuts expected from the Fed

The Federal reserve have been in an easing cycle in 2024, yet they announced their pace of easing will slow significantly in 2025. They also upwardly revised their outlook for growth and inflation to justify the slower pace of easing. While the Fed still expect their interest rate to be below the RBA’s at the end of 2026, the differential has shrunk to a mere -10 basis points (bp), down from -60bp. And it is the narrowing of this spread which helps partially explain why AUD/USD plunged to a 2-year low after the Fed’s December meeting.

Source: Eikon

Trump, tariffs and China

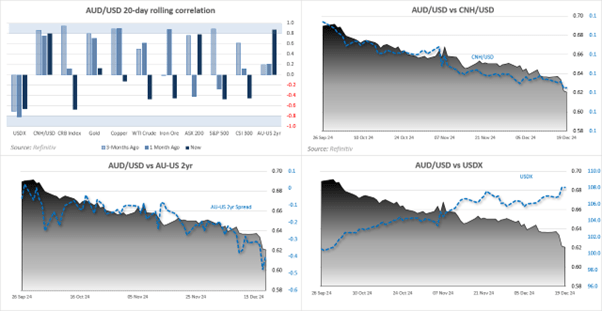

Interest rate differentials are a key driver, but we also need to factor in the threat of Trump’s tariffs and how they tie in with China and their impact on the Australian economy. The previous Trump administration did not directly impose tariffs on Australian exports, and there’s no immediate threat of the new Trump administration doing so this time around. But any actions against China can indirectly hurt Australia.

Trump has already been playing hardball with Canada, Mexico and China with threats of high tariffs on their exports. Beijing is already letting the yuan slide to offset said tariffs via boosted exports. That tends to see their Asian trade partners follow suit amid a ‘race to the bottom’, and AUD/USD tends to get dragged lower for the ride. In recent months, we have seen a very high correlation between a weaker yuan and a weaker Australian dollar. Add into the mix a strong US economy and US dollar, it is not looking too great for AUD/USD bulls next year. At least initially.

As a weaker currency is inherently inflationary (via higher import costs), there will surely come a point where a weak Australian dollar becomes a political talking point and the RBA may become less dovish to support the currency. We may not be there yet, but the topic becomes more important the lower the currency falls.

Source: RBA

What a load of politics

Australia’s Prime Minister’s term ends on 2025, but due to procedural factors around the Senate half term it is estimated the latest the next election can be is May 17th. In theory, it could come as early as March. But as both major parties want lower interest rates, I suspect they’ll hold it as late as possible in hope that the RBA may have already cut by then.

However, current Treasurer Jim Chalmers has been busy doing his bit to make sure that cuts arrive by installing allegedly dovish RBA board members. There is some debate as to whether they are more dovish than current board members, but if they have been hand-picked by the government, my bet is that they are. And as the two latest board members come from banking backgrounds, it breaks the mould of the RBA’s ‘steady as she goes’ approach. Therefore, the pressure to cut sooner may already be in play. But as mentioned above, a weak Australian dollar could be the next political hot potato if the downtrend persists for AUD/USD.

It is also not unreasonable to think that Trump will want a weaker US dollar if its current trend continues, later in the year.

This is an excerpt from our full 2025 AUD/USD Outlook report, one of nine detailed reports about what to expect in the coming year.