-

Dec 27th: Japan set to release key economic data and BoJ summary of opinions

-

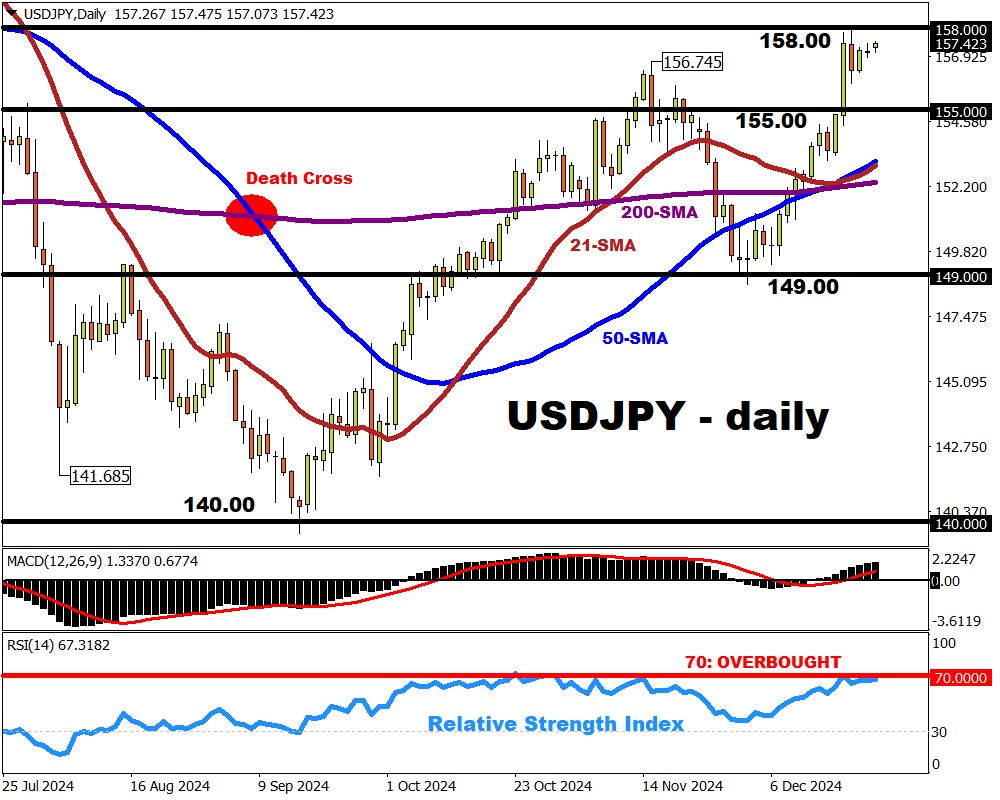

Bloomberg model: USDJPY to trade between 155.5 – 159.0 through Jan 2nd

-

Dec 27th: Bitcoin faces historic options expiry event, worth over US$14.5 billion

- Some Bitcoin bulls betting on $110k BTC by end-January 2025

Bitcoin and Yen traders may not be done with 2024 just yet.

Even as various asset classes are experiencing thinned-out trading during this seasonally sluggish year-end period, these 2 major instruments could see sizeable trading opportunities tomorrow.

Here’s what’s happening on Friday, December 27th:

1) Japan data dump and release of Bank of Japan (BoJ) summary of opinions

Here are the predictions from economists:

- Tokyo CPI (December): 2.9% rise year-on-year (December 2024 vs. December 2023).

(higher than November 2.6% headline inflation figure)

-

Tokyo CPI excluding fresh food and energy prices (December): 1.9% rise year-on-year

(matching November’s core inflation figure)

- Jobless rate (November): 2.5%

(matching October’s figure

- Retail sales (November): 1.5% rise year-on-year

(slightly lower than October’s 1.6% figure)

- Industrial production (November): 3.2% drop year-on-year

(an about turn from October’s 1.4% year-on-year growth)

Also, the BoJ is due to release the summary of opinions from last week’s policy meeting.

POTENTIAL SCENARIOS:

-

BULLISH: USDJPY may break above the stern psychological resistance of 158.00 if the incoming economic data allows the BoJ to pause for longer before its next rate hike.

The Yen could further weaken (higher USDJPY) if the summary of opinions support the dovish undertones conveyed by BoJ Governor Kazuo Ueda after the Dec. 19th rate decision, echoed during his Christmas Day speech.

-

BEARISH: USDJPY may fall towards 155 if Friday’s economic data releases, especially higher-than-expected CPI prints, support the case for a sooner-than-later BoJ rate hike (by Jan 2025?), coupled with more hawkish signals out of the BoJ’s summary of opinions, contrasting Governor Ueda’s dovish rhetoric of late.

2) Bitcoin’s historic US$14.57 billion options expiry date

Tomorrow is a day of reckoning for many crypto investors and traders who have made forecasts on Bitcoin’s future price via the options market.

NOTE: Options are financial contracts that give traders the right, but not the obligation, to buy or sell the underlying asset at a specific price by a specific date.

According to the latest data on Deribit – the crypto exchange with the largest market share in crypto options:

More than US$14.5 billion – a Deribit record high - worth of Bitcoin options are due to expire tomorrow (Friday, Dec. 27th).

Without going into the mechanics of how options contracts can influence the underlying asset’s price ...

Overall, Bitcoin prices may see heightened volatility around this major expiry date.

Already, Bitcoin is seeing a sharp drop at the time of writing, on the eve of the December 27th expiration date.

Yet, prices remain rangebound between $92k and $100k which it has adhered to for much of the past month (barring its spike to the current all-time high above $108,000).

What’s next for Bitcoin after December 27th?

After this Friday’s closely-watched options expiration event, Bitcoin bulls may then wrest back control and push prices back above $100,000, assuming the upward momentum remains intact.

From a fundamental perspective:

-

Crypto fans remain hopeful that US President-Elect Donald Trump would roll out crypto-friendly policies, especially given the pro-crypto stances of several of Trump’s already-nominated officials, including his nominee for SEC Chair, Paul Atkins.

- MicroStrategy – a software maker turned Bitcoin stockpiler – is looking to buy up more Bitcoin over the next 3 years by issuing more shares in raising about US$42 billion.

MicroStrategy has already been buying Bitcoin for the past 7 weeks straight.

More hefty buying in the market could drive prices higher, or at least put a floor below BTC prices.

Going back to the options market and looking beyond December 27th …

Deribit’s data show the largest concentration of “call options” at the $110,000 strike price, expiring on 31st January 2025.

If such speculative bets prove true, that could spell further gains for Bitcoin in the month ahead.