This is an excerpt from our full 2025 Bitcoin Outlook report, one of nine detailed reports about what to expect in the coming year.

Why Bitcoin (Still) Likely Has Not Reached a Cycle Top Yet

Over a longer-term horizon though, there are plenty of indicators that suggest we may still be a way, in both time and price, from a cycle top in Bitcoin.

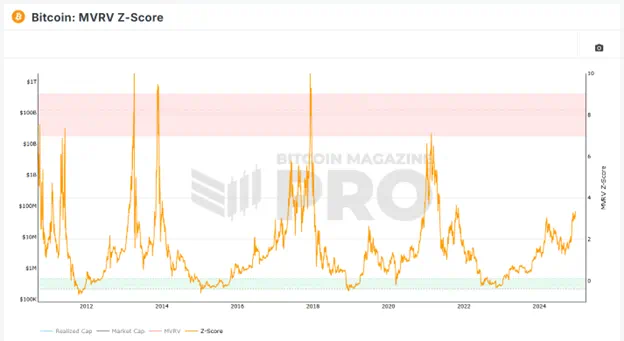

The MVRV (Market Value to Realized Value) Z-score, which compares the current price to the aggregate cost paid for all outstanding Bitcoin, has moved up from the < 1 level that has historically marked bear market bottoms in early 2023 to roughly 3 as of late December 2024.

However, as the chart above shows, previous cycle tops haven’t formed until this indicator reaches levels above 7, suggesting that we may still have further to rally before reaching a cycle top (though given Bitcoin’s limited historic record, it’s important to remember that the current cycle may not necessarily match previous patterns):

Source: Bitcoin Magazine. Past performance is not indicative of future returns.

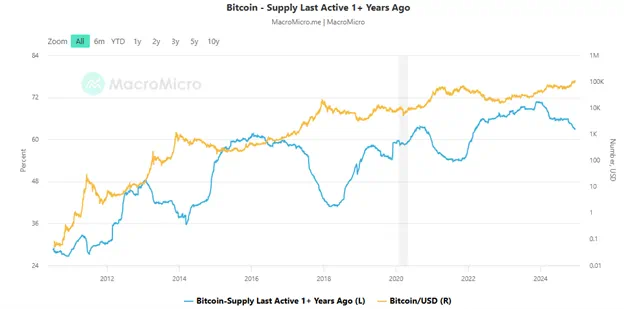

A final consideration is the behavior of long-term holders. As we’ve noted in previous outlooks, those who have held their Bitcoin for more than a year, almost tautologically, are not trying to make a “quick buck” off the cryptocurrency; rather they are more likely to be “true believers” or “HODLers” who are unlikely to sell unless they’re sitting on a truly massive gain.

As the chart below shows, the proportion of Bitcoin that has been held for at least a year started 2024 at record highs above 70% before seeing a notable decline to below 63% as of writing in late December. While a 7% drop may seem relatively small, it represents nearly 1.4M in marginal Bitcoin supply, offsetting some of the large ETF inflows. This measure, by definition, moves relatively slowly, but longer-term “HODLers” may continue to sell the cryptocurrency for as long as it continues to appreciate:

Source: MacroMicro.me

Of course, the catalysts we highlight in this report may not play out as expected – and to some extent, they may already be priced in so readers should always exercise caution when trading Bitcoin and other cryptoassets. As ever, it will be critical to monitor a broad swath of macroeconomic and crypto-specific metrics as the year develops.

Bitcoin Technical Analysis – BTC/USD Weekly Chart

Source: TradingView, StoneX

Looking at the longer-term chart, Bitcoin has broken out of the high base/bullish flag pattern that constrained prices through the middle two quarters of 2024. After a breakout from a prolonged consolidation pattern, the strong one-way continuation rally through November and December is not surprising.

Moving forward, traders will be keen to see where the proverbial “rubber hits the road” when it comes to policy changes and general institutional acceptance in 2025. From a purely technical perspective, prices are “overbought” as of writing, raising the risks of a near-term pullback in the early part of 2025, but as long as the inflows into the asset class remain robust, we would expect traders to buy up shallow dips aggressively and ultimately push Bitcoin to $150K+ this year.

To the topside, the next levels to watch are at $123K (the 200% extension of the 2021-2022 drop) and $156K (the 261.8% Fibonacci extension of the same drop).To the downside, only a break back below the previous record highs in the $70K area would call the bullish cycle thesis into question.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX

This is an excerpt from our full 2025 Bitcoin Outlook report, one of nine detailed reports about what to expect in the coming year.