The trend is your friend, but in this case, I am going against that notion to provide a short fundamental idea on the rallying USD/JPY for 2025. That doesn’t mean you need to step in right away, but only once the appropriate bearish pattern emerges and we have a confirmation of a top.

The Japanese yen was expected by many analysts to stage a stronger performance in 2024 than in the preceding years as the Bank of Japan was expected to normalise its policy after diverging significantly from other major central banks in the preceding years. Well, that didn’t quite happen, and the USD/JPY looked set to finish higher for the 4th year, with the yen also falling for the 5th year against the euro, franc and Aussie dollar. However, with the USD/JPY approaching the intervention territories of around 157.00-160.00 range late in the year in 2024, it will be interesting to see how the currency pair will perform in the early parts of 2025. In any case, I think the yen is due a sharp rally in coming months and for that reason shorting USD/JPY is my top trade idea for 2025.

Bank of Japan could normalise policy

On 20th December, the BoJ kept their interest rate steady at 0.25%, though the yen's big negative reaction on that day suggests there was some lingering hopes for a rate hike. While the chances of a hike had significantly dropped by the time the BoJ met, they were nonetheless expected to be more hawkish than striking a notably dovish tone, signalling no urgency to tighten policy. But with inflation remaining above the BoJ’s 2% target, this is the right time for the central bank to start tightening its belt, just in case it will need to loosen it again when then economy warrants.

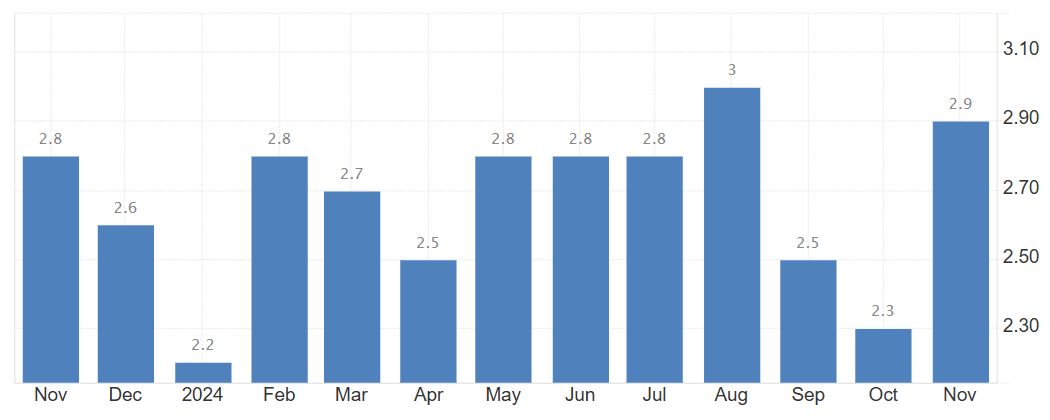

In fact, Japan's annual inflation rate rose to 2.9% in November, up from 2.3% in October, reaching its highest level since October 2023. Food prices saw their sharpest increase in eight months, climbing 4.8% compared to 3.5% in October, driven primarily by surging costs for fresh vegetables and other fresh food items. With the yen weakening again in December, prices of imported goods and services should rise further and keep inflation elevated in 2025.

Source: Trading Economics.com

With above-target inflation remaining persistent for much of 2024, price pressures could increase further should the yen weaken even more. To support its currency, the Bank of Japan may wish to start raising rates more meaningfully to align Japan’s policy a little closer to those of other major economies. So, I believe the central bank may be better positioned to raise rates next year.

US dollar: Potential unwinding of Trump and carry trades

So, one potential major source of support for the yen could be in the form of unwinding of carry trades, should we see the Bank of Japan further normalise its policy. The other factor could be major central banks outside of Japan start cutting their rates aggressively, triggering a rally in global bond prices or causing their yields to fall. Yet another source of support for the yen could come in the form of a major risk-off scenario boosting the appeal of the perceived haven currency.

Of most important for the USD/JPY will be bond yields. As of the end of 2024, the yield on the 10-year US bond had reached 4.5%, significantly more than in Japan. There is a chance we could see US yields retreat in 2025. After all, much of the gains for US yields and the dollar in 2024 were due to the Fed turning out to be less dovish in the end than the markets had priced in earlier in the year owing to first to surprising strength in US data and then later because of expected policy shifts under Donald Trump in 2025. But if Trump fails to ignite a strong economic recovery, or concerns rise further about the US debt situation, then in 2025 we could see a sharp unwinding of the “Trump trade,” characterised by strong US dollar, equities and cryptocurrencies.

Thus, a potential flight to safety, drop in US bond yields, or government intervention could all help to weaken the USD/JPY in 2025. For that reason, we think the risks are tilted to the downside.

USD/JPY key levels to watch

Source: TradingView.com

From a technical standpoint, we identify the area between 156.75 to 160.00 as being a major resistance zone, as per the above weekly chart of the USD/JPY. However, with the trend being quite bullish in the latter months of 2024, a clear reversal needs to be identified on the daily time frame before we turn tactically bearish on the USD/JPY. For me, the trigger would be if rates were to now break the December low of 148.65. A potential break below that level could potentially pave the way for a move to 145.00 or possibly even revisit the September low beneath 140.00. Key support comes in around 150.00-151.20 area (blue shaded zone on the chart), which we will need to give way for this idea to come to fruition.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R