- Will Trump 2.0 push USD to multi-decade highs?

- Uncertain market dynamics to drag oil to Covid-19 lows?

- FXTM’s EU50 to dazzle with fresh records in 2025?

In 2025, global financial markets will arguably revolve around one dominant force: US President Donald Trump.

Given our Trump-centric focus, we highlight 3 key assets that could serve up major opportunities for traders and investors this year:

1) USDInd to see best year in a decade?

The US dollar index has just wrapped up 2024 with an annual gain of 7%.

This year could see further dollar gains, potentially by double-digits!

Here are 3 key factors that could feed the stronger dollar environment in this new year:

- Slower Fed rate cuts on Trump’s “America First” policies.

As things stand, markets predict that the Fed’s benchmark rates will be 50 basis points lower by end-2025.

Trump’s proposed tax cuts, tariffs and mass deportation threaten to revive US inflation which had been cooling down towards the Fed’s 2% target in recent years.

Note: Higher tariffs boost costs for importers who may pass on those higher prices to consumers a.k.a inflation.

If this forces the Federal Reserve to cut rates slower-than-expected, the dollar stands to appreciate.

Note: A currency tends to strengthen when interest rates in its country stays higher relative to its major peers.

- US exceptionalism

Trump’s proposed policies appear to significantly reduce the odds of a US recession.

Furthermore, Trump’s protectionism may hark back to the global trade wars that were a hallmark of his first administration, which could in turn weigh down other major economies such as the Eurozone and China.

Hence, if the world’s largest economy fares much better than the rest of the world, that should in turn spur more demand for the US dollar.

- Safe haven demand

Heightened geopolitical conflicts across the globe may keep sending investors toward the dollar, which is widely seen as a safe haven asset.

Note: A safe-haven is an asset that helps investors and traders preserve their wealth during times of heightened fear and uncertainty.

As long as the Russia-Ukraine conflict and the Middle East turmoil risk being protracted, along with any other fear-inducing events that await us in the new year, that should ensure some safe haven demand along the way.

On the flip side…

The dollar could weaken if Trump fails to move ahead with promised tax cuts and adopts a less aggressive approach to tariffs.

If this allows room for lower US interest rates, the dollar could remain on the backfoot.

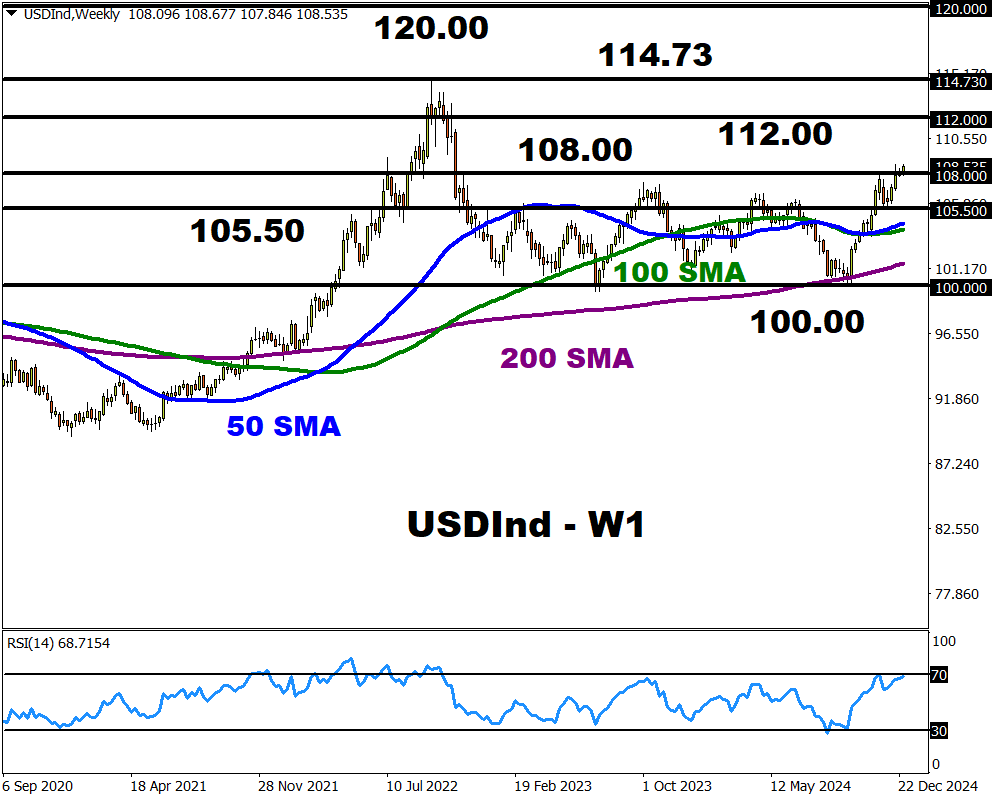

Technical outlook…

FXTM’s USDInd is firmly bullish on the weekly charts with prices but the Relative Strength Index (RSI) is near overbought territory.

- A strong close above 108.00 could open a path toward 112.00 and levels not seen since year 2002 at 120.00.

- Should prices slip under 105.50, bears may target the 50-week SMA at 103.90, 102.70 and 100.00.

2) Oil to hit Covid-19 pandemic lows?

Oil benchmarks are set for a rocky 2025 if Trump’s proposed tariffs hit China’s economy, despite the decision by OPEC+ to delay its intended output hikes till April, for now...

Oil traders will have their hands full over the course of the new year.

Besides more Trump-imposed tariffs hurting global oil demand, especially in China, here’s a snapshot of major factors for traders to keep their eye on:

- Global oversupply: The EIA has forecast that oil supply will exceed demand by more than 1 million barrels a day in 2025.

- OPEC+ output hike: OPEC+ has already delayed its planned production hikes three times in 2024, it is only a matter of time until they release more oil into the markets.

- Drill baby drill: Trump’s return to the White House could mean an increase in US oil and gas production. Greater supplies amid still-weak demand could drag oil lower.

- Still-elevated Fed rates: If this pushes up US petrol prices, inflation could rise – forcing the Fed to cut rates slower than expected and boosting the USD a result. A stronger dollar typically results in lower oil prices.

On the flip side…

- China: Oil benchmarks may rise if growth in the world’s largest energy consumer - China bounces back in 2025.

- Iran sanctions: Trump has also threatened to further cap Iran’s oil exports in stricter adherence to sanctions. If so, this could create a gap in global supplies for US and/or OPEC+ producers to fill.

- Geopolitical risk: The ongoing conflict in the Middle East could add additional spice to oil prices, considering the region is home to almost a third of global oil supply.

- A weaker dollar from Fed rate cuts may boost oil which is priced in dollars.

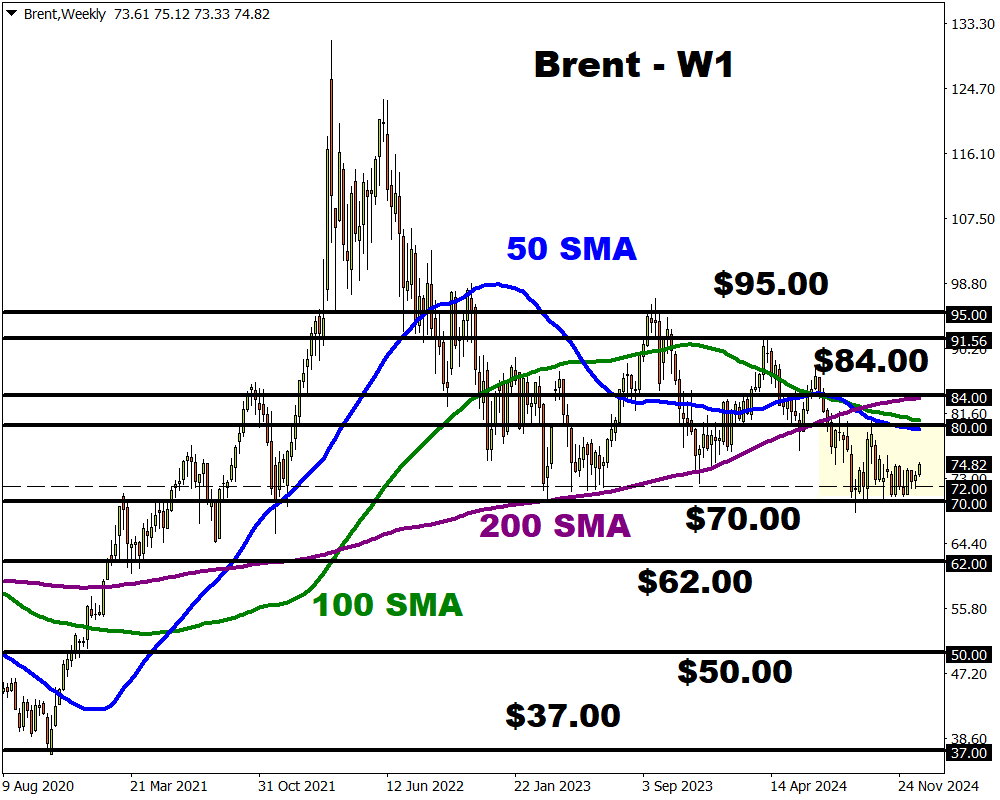

Technical outlook

Keep an eye on the critical weekly support at $70.00. The last time Brent secured a weekly close below this level was back in August 2021. Prices are trading below the weekly 50, 100 & 200 SMA.

- A solid weekly close below $70 may open a path toward $62, $50 and $37.

- Should bulls push prices back above $80, this could trigger an incline toward the 200-week SMA at $84. $91.50 and $95.

3) FXTM’s EU50 to play catch up in 2025?

Politics, Trump and China spell trouble for European equities in 2025.

But with all bearish fundamental themes, could FXTM’s EU50 come out on top by hitting fresh record highs?

Note: EU50 tracks the benchmark Euro Stoxx 50 index.

Here are 4 major factors that may hit the index in the new year:

- Elections: The political developments seen in Europe’s two biggest economies is not over. Both Germany and France saw their governments collapse last year, with snap elections expected to take place in February and July respectively.

- Trump’s trade war: Trump’s proposed 10% universal US tariffs may hit European exports, potentially impacting the Eurozone’s GDP.

- China’s economy: China which accounted for almost 10% of EU exports in 2023 is back within Trump’s crosshairs. He has already pledged to impose 60% tariffs on all goods imported to the US from China.

Note: Slower growth in China is bad news for European companies from luxury brands to car makers as lower profits threaten share prices.

- Russia-Ukraine war: Geopolitical tensions may continue pressuring EU growth the uncertainty dampening appetite for European stocks.

On the flipside…

- ECB rate cuts: The EU50 could be supported by ECB rate cuts. Markets expect the ECB to cut rates by 125 basis points in 2025. And this number could be greater due the risks to Europe’s economy.

- Easing Ukraine tensions: A potential ceasefire in Ukraine may boost sentiment towards European equities. If this ceasefire also eases the pressure from high energy prices, this may allow more aggressive ECB cuts.

These bullish factors could provide a tailwind for European stocks.

According to Wall Street experts, the index could hit 5632 over the next 12 months.

Technical outlook

Prices remain in a range on the weekly charts with support at 4700 and resistance at 5110.

- A solid weekly close above 5110 may open a path toward 5250 and the all-time high at 5522. Beyond this point, prices may venture toward 5632.

- Should bears drag prices below 4700, the next key levels can be found at 4470, the 200-week SMA at 4250 and 4000.