The 10-year Treasury yield is an important indicator of the health of the U.S. economy, and its movements can have a significant impact on financial markets around the world. In recent weeks, the yield on the 10-year Treasury note has been on the rise, reaching levels not seen in over a year.

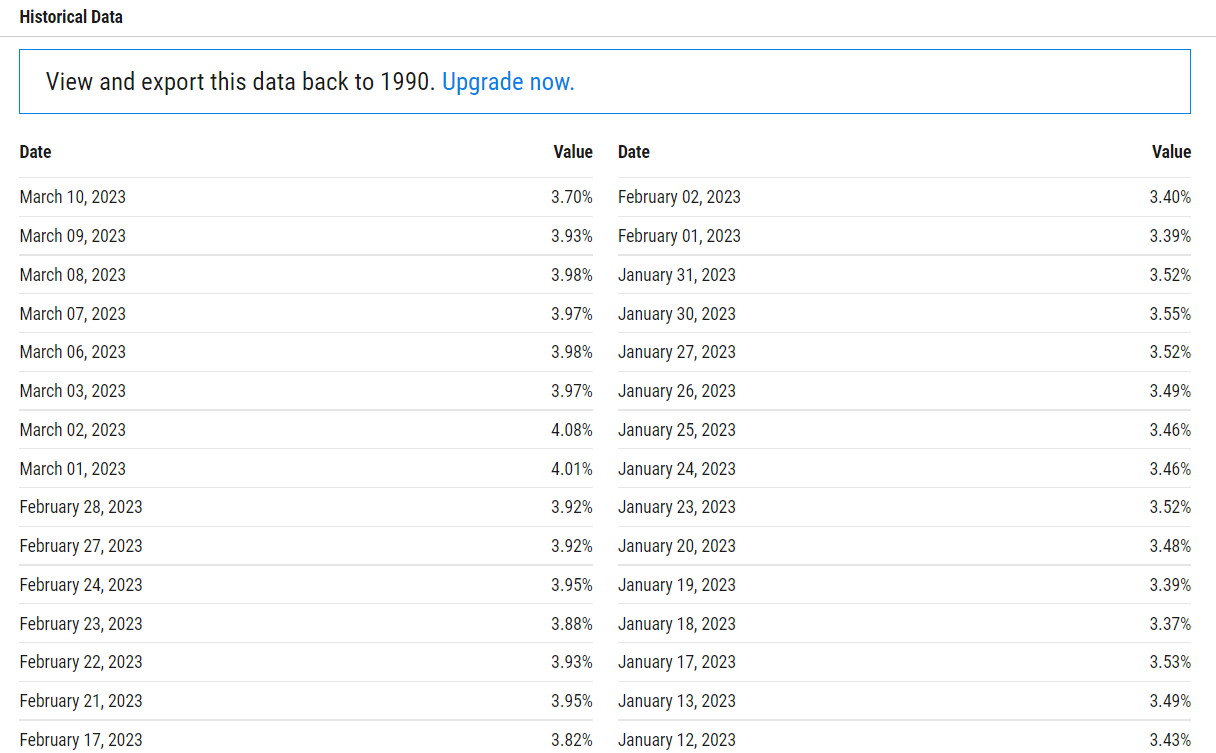

The 10-year Treasury yield rose above 1.5% in late February 2021, and it has continued to climb since then. On March 10, 2023, the yield reached 2.1%, its highest level since January 2022. This sudden rise in yield has been attributed to a number of factors, including inflation concerns, economic growth prospects, and the Federal Reserve's monetary policy.

One of the key drivers of the recent rise in the 10-year Treasury yield is inflation. Inflation measures the rate at which prices for goods and services increase over time. If inflation rises too quickly, it can be harmful to the economy, causing prices to spiral out of control and eroding the purchasing power of the dollar. As a result, the Federal Reserve has been closely monitoring inflation and adjusting its monetary policy to keep it in check.

Another factor contributing to the rise in the 10-year Treasury yield is the expectation of strong economic growth in the coming months. As the COVID-19 pandemic recedes and more people are vaccinated, economists expect consumer spending to pick up, businesses to expand, and hiring to increase. This anticipated growth in the economy has led to higher expectations for future interest rates, which in turn has led to an increase in the 10-year Treasury yield.

Finally, the Federal Reserve's monetary policy has also played a role in the recent rise in the 10-year Treasury yield. The Federal Reserve has kept interest rates at historically low levels since the Great Recession of 2008, in an effort to stimulate the economy. However, as the economy has begun to recover in recent years, the Federal Reserve has signaled that it may begin to raise interest rates again in the near future. This expectation of higher interest rates has contributed to the increase in the 10-year Treasury yield.

The rise in the 10-year Treasury yield has implications for financial markets around the world. As Treasury yields rise, bond prices fall, leading to losses for investors who hold bonds. This can cause a ripple effect throughout financial markets, as investors sell off bonds and seek higher returns in other assets, such as stocks. The rise in the 10-year Treasury yield can also lead to higher borrowing costs for businesses and consumers, which can in turn dampen economic growth.

In conclusion, the recent rise in the 10-year Treasury yield is a reflection of a number of factors, including inflation concerns, economic growth prospects, and the Federal Reserve's monetary policy. As the yield continues to climb, it will be important for investors and policymakers to monitor its impact on financial markets and the broader economy.