The TWD to EUR exchange rate is one of the most closely watched currency pairs in the forex market. In recent months, the pair has experienced significant volatility due to a variety of factors, including economic data releases and geopolitical events. In this article, we will take a closer look at the current state of the TWD to EUR exchange rate, including recent trends and future expectations.

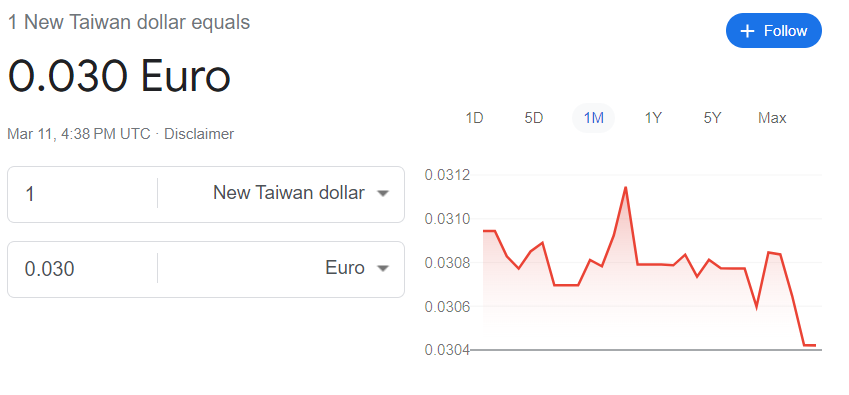

As of March 11, 2023, the TWD to EUR exchange rate was 0.027 euros per Taiwan dollar. This represents a slight increase from the previous day's rate of 0.0269 euros per Taiwan dollar. However, the exchange rate has been quite volatile over the past few months, with swings of several percentage points occurring on a regular basis.

One factor that has contributed to this volatility is the release of economic data from both Taiwan and the eurozone. In recent months, data from Taiwan has been generally positive, with GDP growth of 2.7% in Q4 2022 and a low unemployment rate of 2.6%. This has helped to support the Taiwan dollar and boost the TWD to EUR exchange rate.

However, economic data from the eurozone has been more mixed. While the overall economy has been growing, there have been concerns about inflation and the impact of Brexit on the European Union. In addition, the ongoing COVID-19 pandemic has continued to create uncertainty and volatility in the markets.

Looking ahead to next week, there are several key economic data releases that could impact the TWD to EUR exchange rate. On Monday, March 13, the eurozone will release its industrial production figures for January 2023. This data is expected to show a slight increase from the previous month, which could provide some support for the euro.

On Tuesday, March 14, the eurozone will release its GDP figures for Q4 2022. This data is expected to show a slight increase from the previous quarter, which could help to support the euro and push up the TWD to EUR exchange rate.

Finally, on Wednesday, March 15, the eurozone will release its inflation figures for February 2023. This data is expected to show a slight increase from the previous month, which could put pressure on the European Central Bank to raise interest rates and support the euro.

In conclusion, the TWD to EUR exchange rate has been volatile in recent months due to a variety of factors, including economic data releases and geopolitical events. While economic data from Taiwan has been generally positive, data from the eurozone has been more mixed. Looking ahead to next week, there are several key data releases that could impact the exchange rate, including industrial production, GDP, and inflation figures. As always, forex traders should stay abreast of these developments and adjust their trading strategies accordingly.