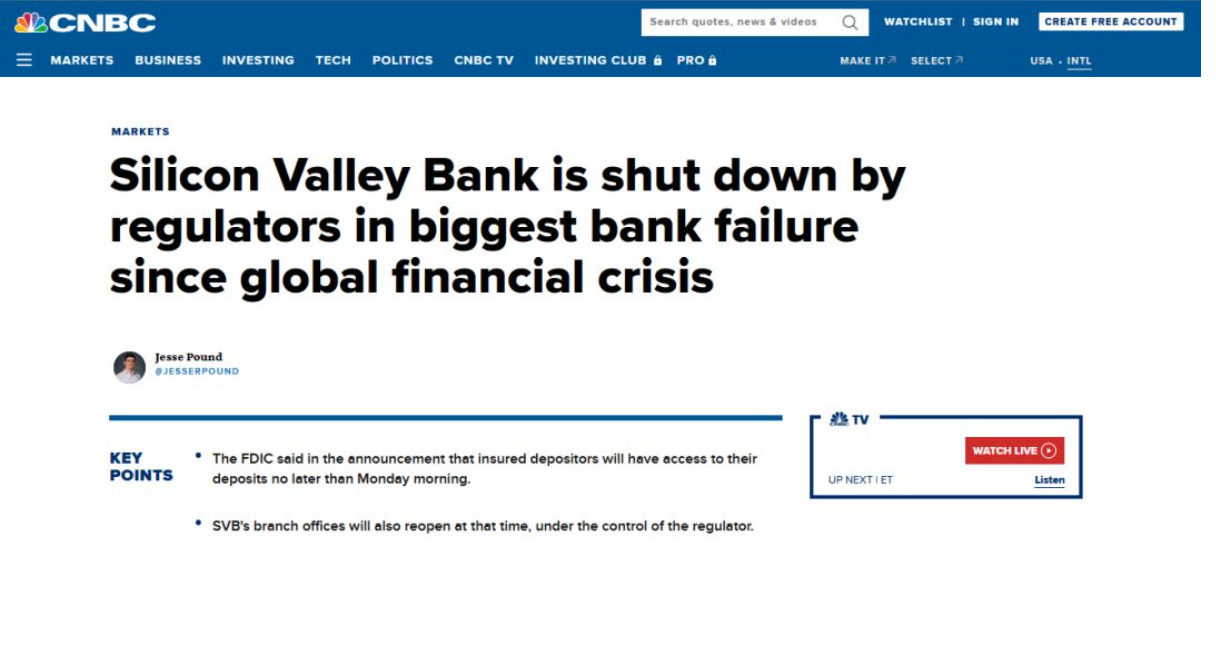

The recent collapse of Silicon Valley Bank has sent shockwaves throughout the global tech industry, particularly among startup companies that rely heavily on the bank's services. Many of these companies are struggling to stay afloat in the wake of this unexpected turn of events.

Silicon Valley Bank was a popular choice among tech startups due to its focus on providing specialized financial services to emerging companies. However, the bank's demise has left many startups without access to critical funding and support, leaving them vulnerable to bankruptcy and closure.

In addition to the immediate financial impacts of the bank's collapse, there are also concerns about the long-term implications for the tech industry as a whole. Silicon Valley Bank was a key player in the startup ecosystem, and its sudden disappearance has created a void that will be difficult to fill.

Some industry experts are calling for greater regulation and oversight of the financial sector to prevent similar collapses from occurring in the future. Others are advocating for alternative sources of funding and support for startups, such as crowdfunding and incubator programs.

Regardless of the solution, it is clear that the collapse of Silicon Valley Bank has had far-reaching consequences for the global tech industry. Startup companies must now navigate an uncertain landscape as they seek new sources of funding and support to keep their businesses afloat. Only time will tell what the future holds for these innovative companies and the tech industry as a whole.

In the aftermath of the collapse of Silicon Valley Bank, Chinese entrepreneurs are currently in the process of transferring their funds to other financial institutions. This move comes as a result of concerns about the stability and reliability of traditional banking systems in light of recent events.

Chinese Entrepreneurs Transfer Funds Amid Bank Collapse

Silicon Valley Bank was a popular choice among Chinese entrepreneurs, particularly those in the tech industry, due to its focus on providing specialized financial services to emerging companies. However, the bank's sudden collapse has left many Chinese entrepreneurs without access to critical funding and support, leading to a rush to transfer funds to more stable institutions.

Many Chinese entrepreneurs are also exploring alternative funding sources, such as crowdfunding and venture capital firms. These alternative sources of funding offer a greater level of flexibility and control over the investment process, making them an attractive option for entrepreneurs who are wary of traditional banking systems.

Despite these efforts to mitigate the impact of the Silicon Valley Bank collapse, there are concerns about the long-term implications for the Chinese tech industry. The loss of a key player in the startup ecosystem could have far-reaching consequences for the industry as a whole, particularly for those entrepreneurs who are still in the early stages of building their businesses.

In response to these concerns, some industry experts are calling for greater government support for startups and alternative funding sources. This could include initiatives such as tax incentives for venture capital firms and increased investment in incubator programs.

Overall, the collapse of Silicon Valley Bank has had a significant impact on Chinese entrepreneurs, forcing many to re-evaluate their funding and investment strategies. While there are challenges ahead, there are also opportunities for innovation and growth in the Chinese tech industry as entrepreneurs explore new ways to access funding and support for their businesses.