A renewed sense of caution gripped financial markets on Wednesday as worries over Credit Suisse Group AG added to the mounting unease.

Investors were already on high alert after the Silicon Valley Bank (SVB) fallout sent shockwaves across the board. With contagion fears fuelling risk aversion, investors rushed towards safe-haven destinations. In the equity space, European shares flashed red with banking stocks taking a beating. Looking at currencies, buying sentiment towards the USD and Yen received a boost thanks to the risk-off sentiment. Gold also got some love, appreciating 0.7% as prices punched over $1915.

Our focus today falls on safe-haven assets which tend to maintain their value or even appreciate during times of market uncertainty. Examples of such assets range from gold to certain currencies and government bonds.

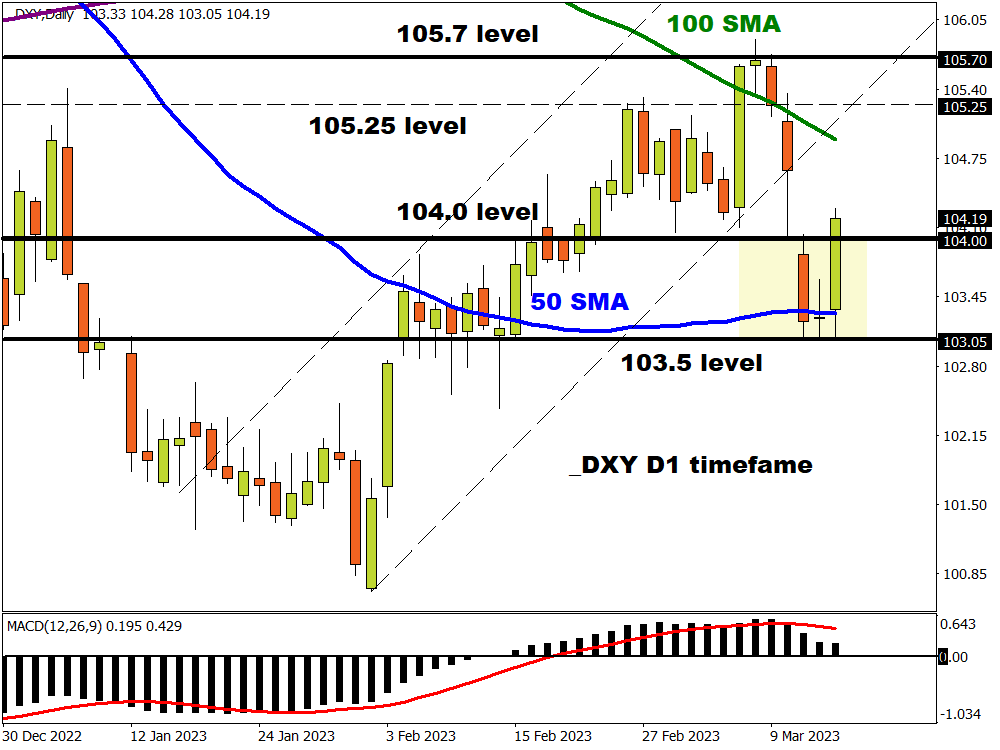

DXY breaks above 104.00

Dollar bulls seem to be drawing strength from renewed rate hike expectations and growing angst over Credit Suisse. After kicking off the week in a sorry fashion, bulls are clearly fighting back – taking prices above the 104.00 level. A solid daily close above this point could encourage an incline towards 105.25 and 105.70, respectively.

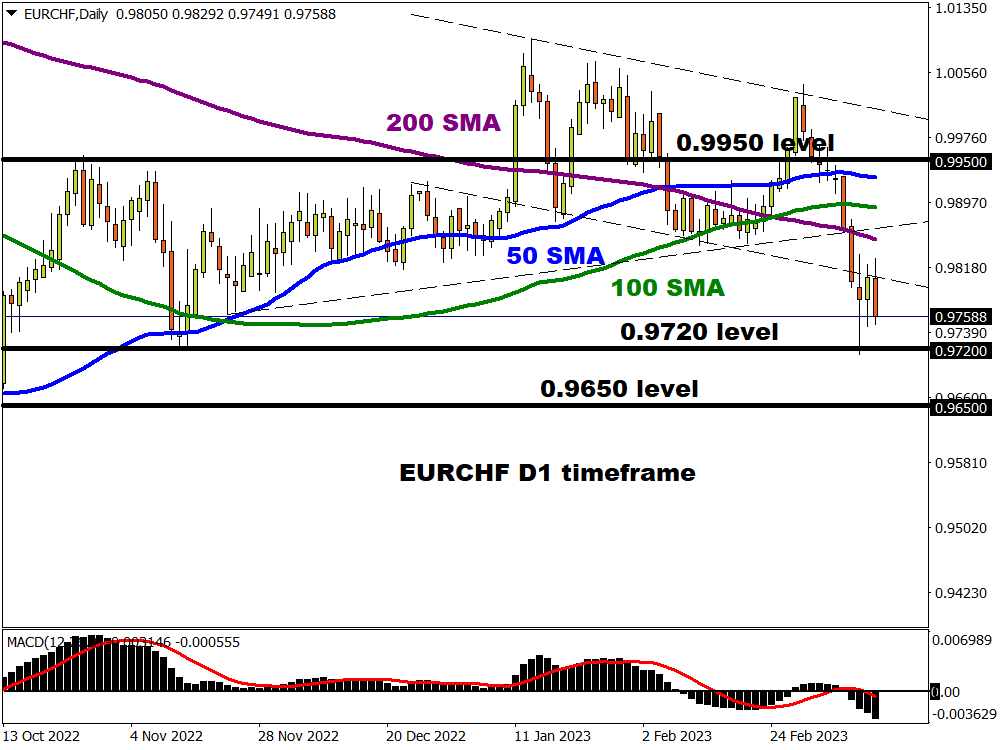

EURCHF breakdown mode?

The risk-off sentiment has sent investors rushing to safety with the Swiss Franc gaining from the safe-haven flows. Price action suggests that bears remain in firm control with 0.9720 acting as a key level of interest. A breakdown below this point could encourage a decline toward 0.9650.

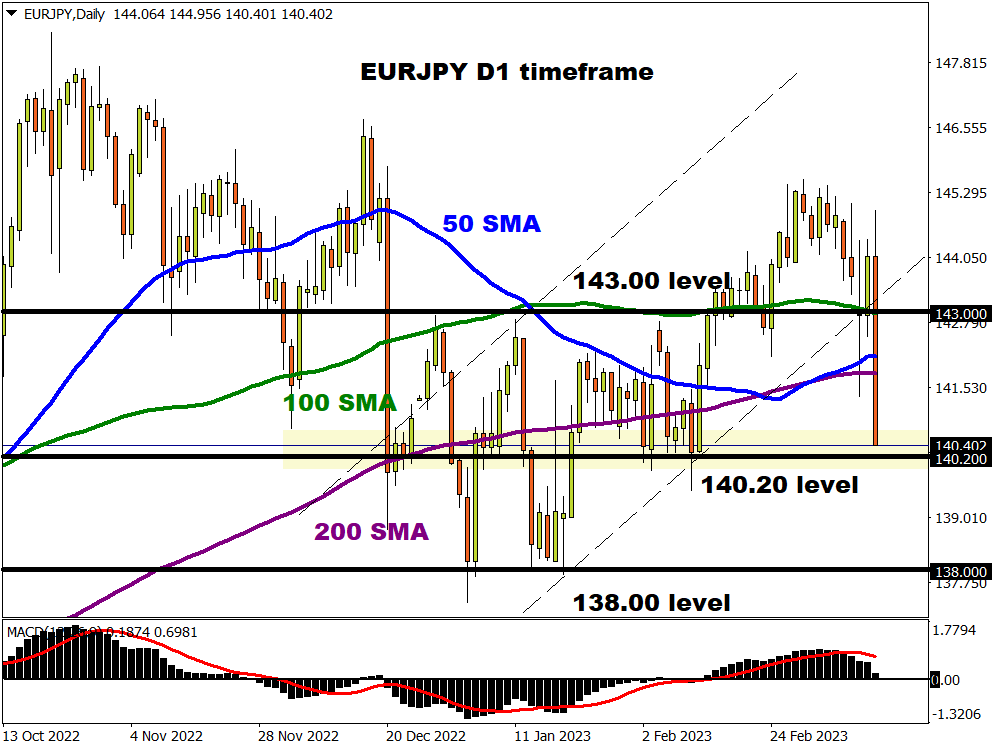

EURJPY bears dominate

The EURJPY collapsed on Wednesday as prices cut through multiple levels of support like a hot knife through butter. Prices have tumbled over 400 pips, with bears eyeing support at 140.20. A strong breakdown below this point could open the doors towards 138.00. Should 140.20 prove to be reliable support, this could trigger a rebound back toward the 200-day SMA at 141.80.

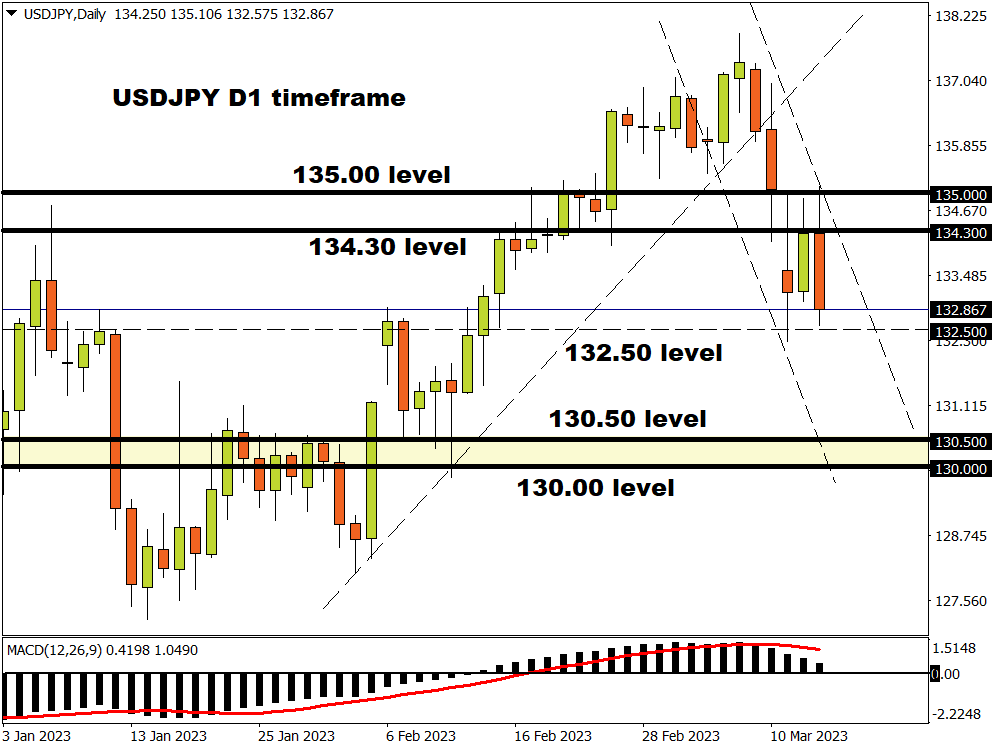

USDJPY tumbles towards 130.50

Yen bulls are certainly on a roll today, dragging the USDJPY toward the 132.50 level. This currency pair is bearish on the daily charts and could sink further if 132.50 is breached. A strong breakdown below this point could encourage a selloff towards 130.50 and 130.00, respectively. For bulls to jump back into the game, the 135.00 resistance needs to be taken out.

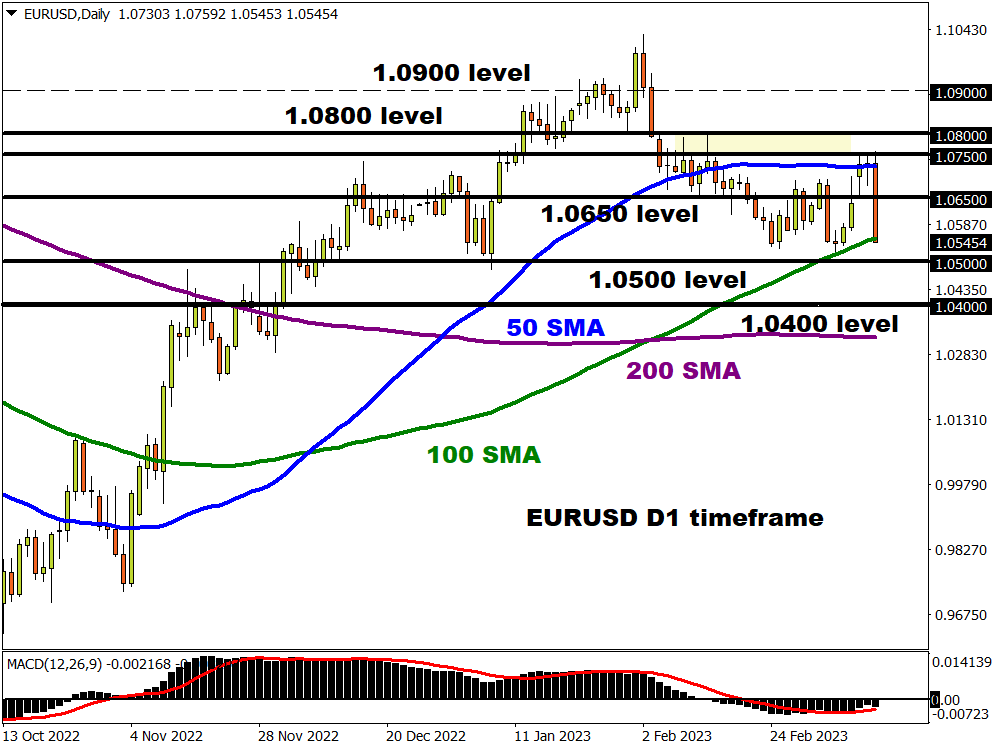

EURUSD to test 1.0500 support?

It has been a pretty wild week for the world’s most traded FX pair. After gapping higher on Monday and barely moving on Tuesday, prices collapsed like a house of cards on Wednesday thanks to a surging dollar. A major bearish breakout could be on the horizon with 1.0500 acting as the first level of interest for bears. A strong daily close below this level could encourage a selloff towards 1.0400. If bulls receive a miraculous lifeline, this could trigger a rebound from 1.0500.

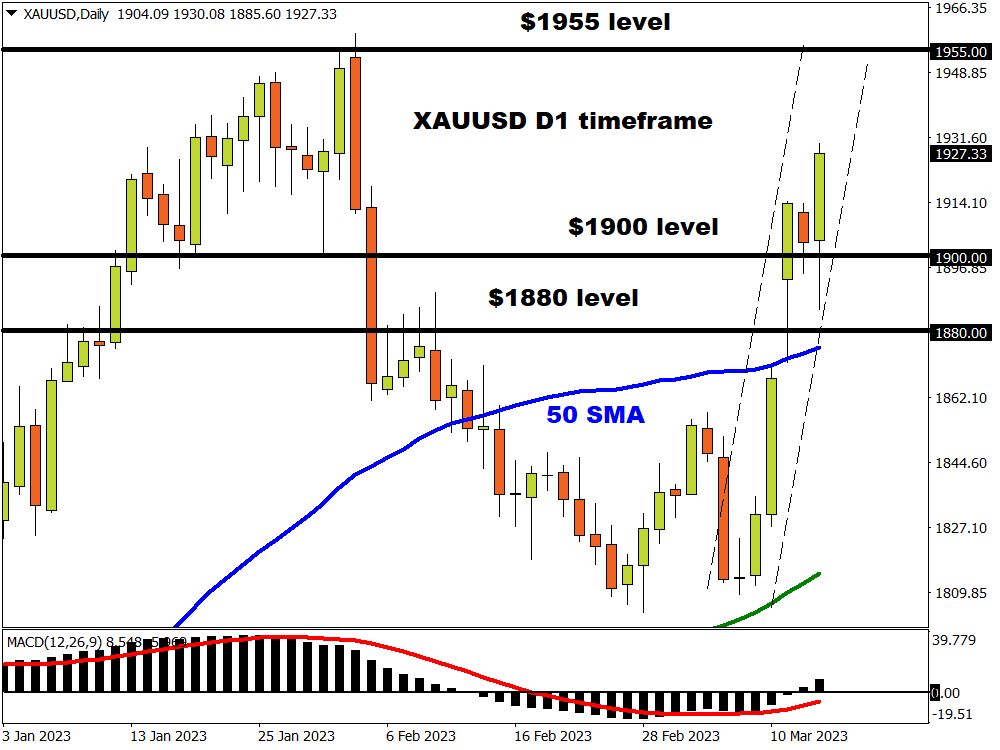

Let’s not forget gold…

Gold prices surged on Wednesday, gaining 1.3% as the metal’s safe-haven appeal magnetised investors around the globe. The growing sense of unease and uncertainty suffocating markets has left investors on edge, boosting buying sentiment towards the precious metal. Prices are firmly bullish on the daily charts with the upside momentum potentially taking prices back toward the $1955 level. Bulls remain in control above the $1900 psychological level.