The explosive price action gold has displayed in recent days mirrors a speeding train reaching maximum velocity, with fundamental forces fuelling the upside momentum.

On Monday, gold punched above $2000 for the first time since March 2022 as concerns over the health of the banking system sweetened the appetite for safe-haven assets. This positive start builds on last week's whooping 6.5% surge as mounting fears around Credit Suisse AG and the overall health of the banking system sent jitters across the board. A palpable sense of unease continues to linger across financial markets despite news over the emergency weekend sale of Credit Suisse AG to UBS Group AG. Contagion fears are rife and this will most likely accelerate the flight to safety, boosting attraction towards safe-haven gold.

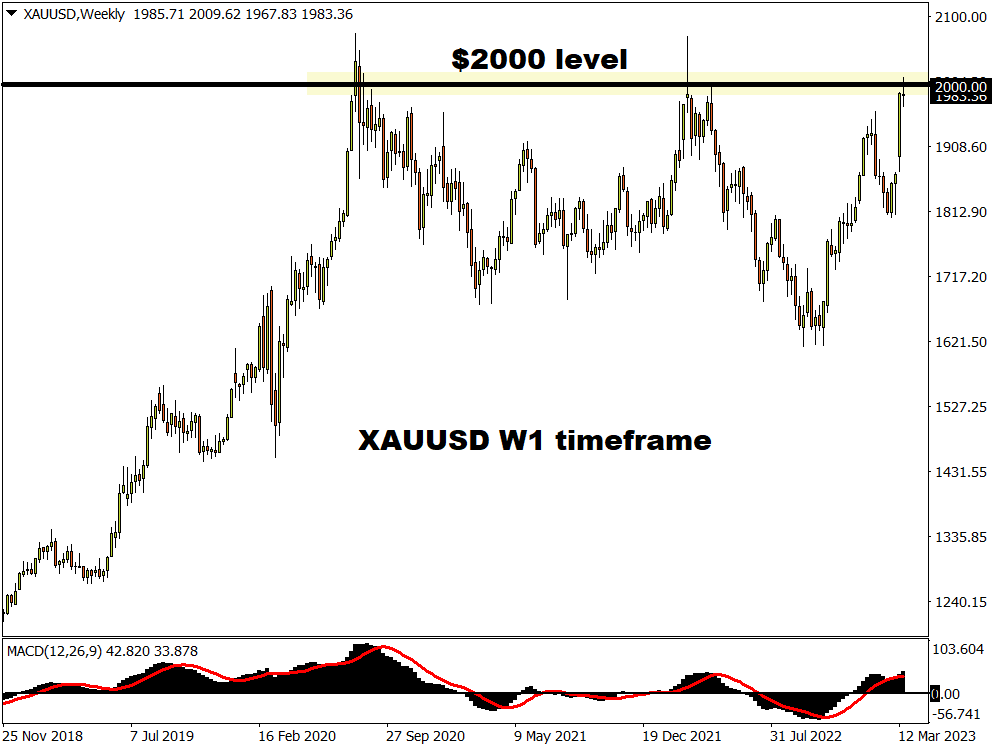

Revisiting our 2023, we thoroughly discussed how gold could be one of the biggest winners these years based on speculation around the Fed pausing rate hikes. While gold prices have surged on contagion fears, the string of negative developments has also tempered expectations around the Fed keeping rates higher for longer. With gold hitting the psychological $2000 level, the key question is whether further upside could be on the cards or the party ends around this resistance.

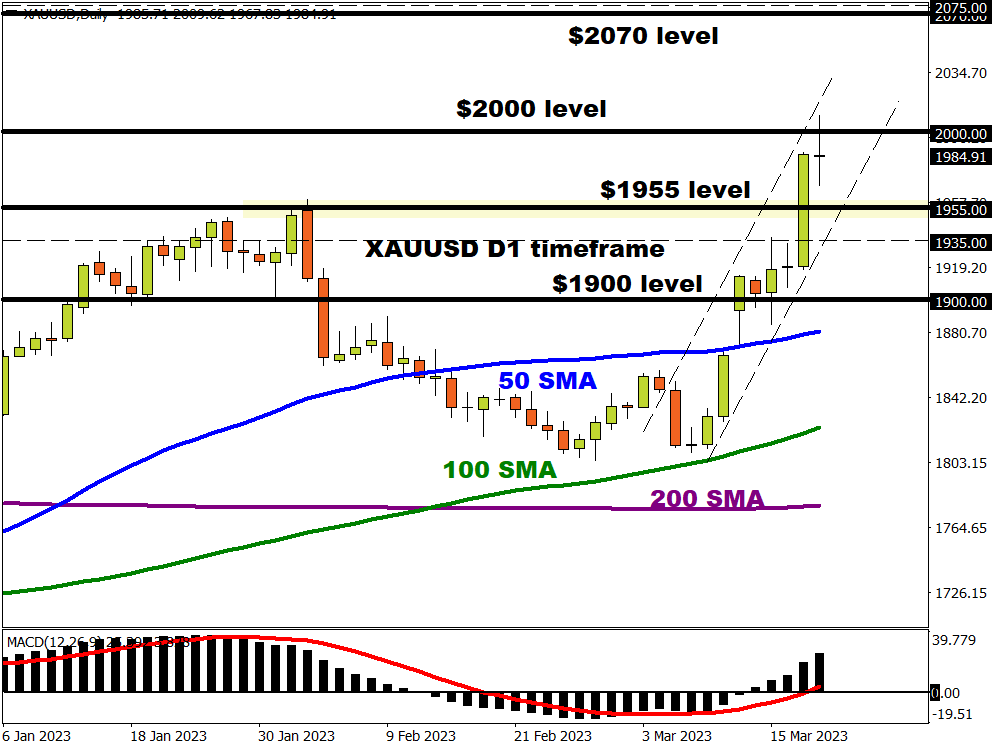

Taking a quick looking at the technical picture, gold is heavily bullish on the daily charts. However, the $2000 level may be a tough nut to crack for bulls. The last time gold secured a weekly close above $2000 was back in August 2020.

The lowdown….

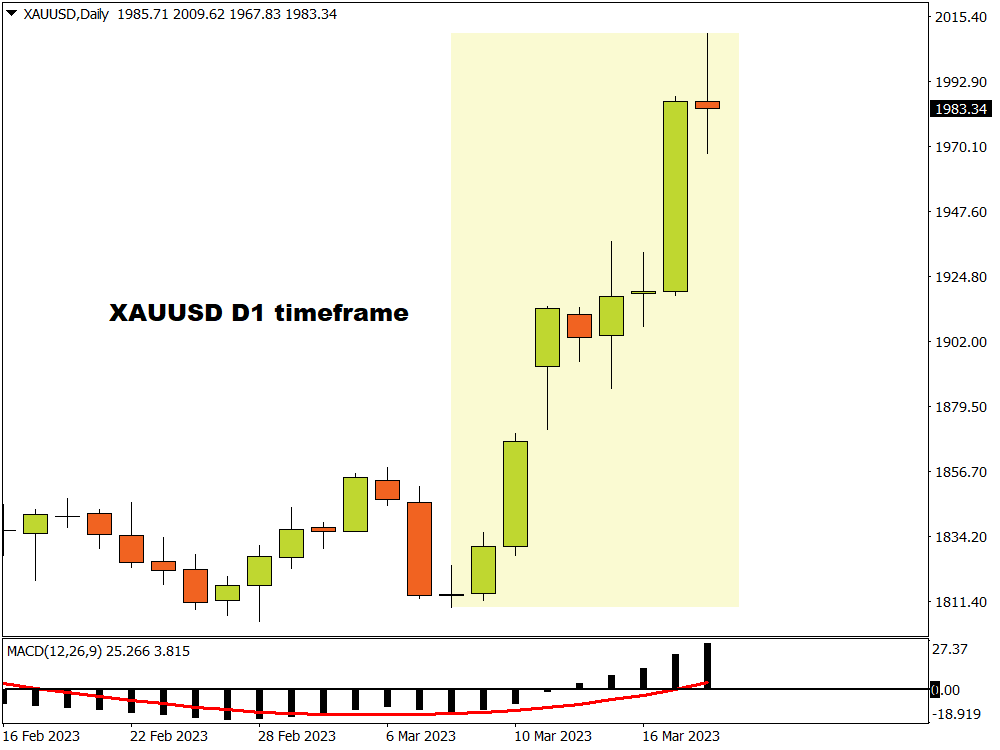

Gold has experienced a sharp change of fortune this month thanks to the market chaos triggered by the Silicon Valley Bank (SVB) collapse and Credit Suisse drama.

The horrible combination of events and growing fears around the banking system sent tremors across financial markets, leaving investors on edge. The wave of risk aversion prompted investors to scatter from riskier assets and rush to safe-haven destinations. Gold prices have gained over 8% this month not only due to contagion fears but expectations around the Fed adopting a less aggressive approach on rates to preserve the financial system.

Concerns over contagion risks and financial stability are likely to influence market sentiment and risk appetite. Any more negative news or developments could spark another wave of risk aversion – ultimately injecting gold bulls with fresh inspiration.

Keep an eye on the Fed meeting

Markets expect the Federal Reserve to raise interest rates by 25 basis points this month. However, this will be a tough meeting for the central bank as it decides whether to focus on macroeconomic data or the stability of the financial system following the SVB collapse and the Credit Suisse drama. There has been a lot of chatter around the recent string of negative developments empowering doves with traders now predicting a 65% chance of a 25bp hike in March - according to Fed Funds Futures.

If the Federal Reserve surprises markets by leaving rates unchanged, this could signal the end of the rate hike cycle with the next move being lower rates. Such a development is likely to send the dollar tumbling along with Treasury yields, which could see gold shine with renewed intensity. Whatever the outcome of the Fed meeting, it may influence gold’s outlook for the remainder of March and possibly beyond.

Can gold conquer $2000?

After bagging its biggest weekly gain since March 2020, gold bulls are clearly in a position of power. The precious metal is drawing strength from multiple sources, ranging from contagion fears, falling Fed hike bets, a softer dollar, and falling Treasury yields. The path of least resistance for the precious metal certainly points north, but can bulls conquer the $2000 level?

From a technical perspective, there have been consistently higher highs and higher lows while prices are trading above the 50, 100, and 200-day SMA. Given how $2000 has proved to be strong resistance in the past, bulls may need to put in the work to secure a solid weekly close above this point. Should $2000 prove to be too much for bulls to handle, prices may sink back toward $1955 before retesting $2000. A solid break above this psychological level may inspire a move higher toward $2070 and levels not seen since August 2020 above $2075.

If bears make a return and drag prices below $1955, the next point of interest can be found at $1935, $1915, and $1900, respectively.