If you have an appetite for volatility, then keep a close eye on the EURAUD!

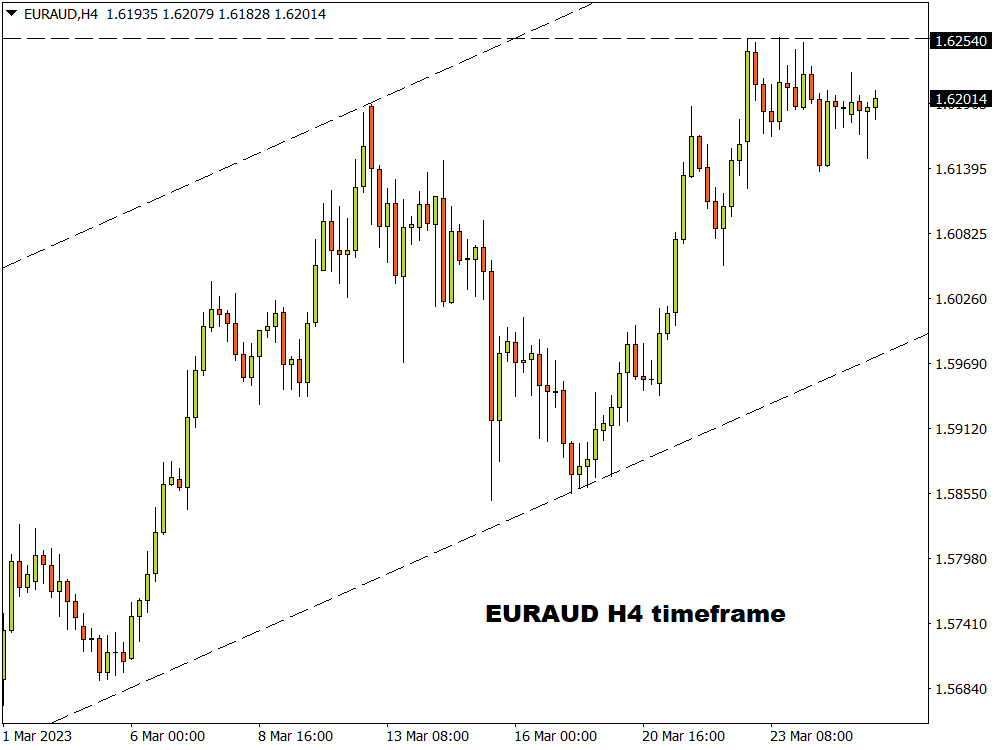

The currency pair has rallied over 550 pips since the start of March with bulls smashing through key levels of resistance with the destructive force of a wrecking ball. After hitting a fresh 2023 high at 1.6254 last week and concluding on a firm note, the path of least resistance certainly points north.

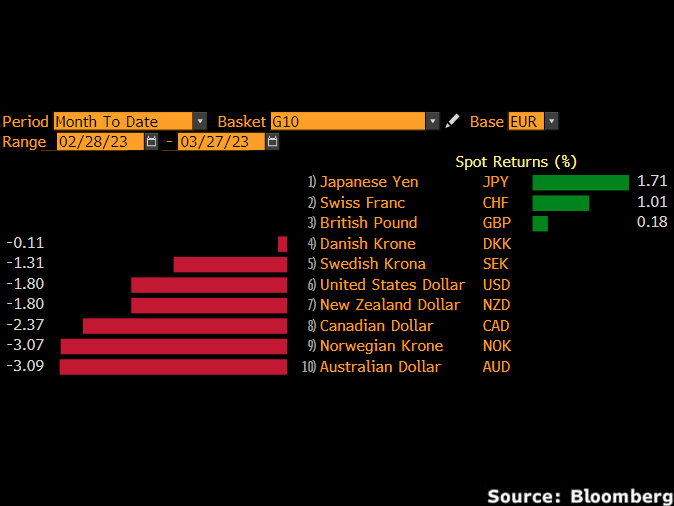

Euro strength remains the primary driver behind the EURAUD’s incredible upside. We have seen the euro appreciate against most G10 currencies month-to-date.

On the other hand, the past few weeks have certainly not been kind to the Australian dollar thanks to risk aversion and concerns over the health of Australia’s economy.

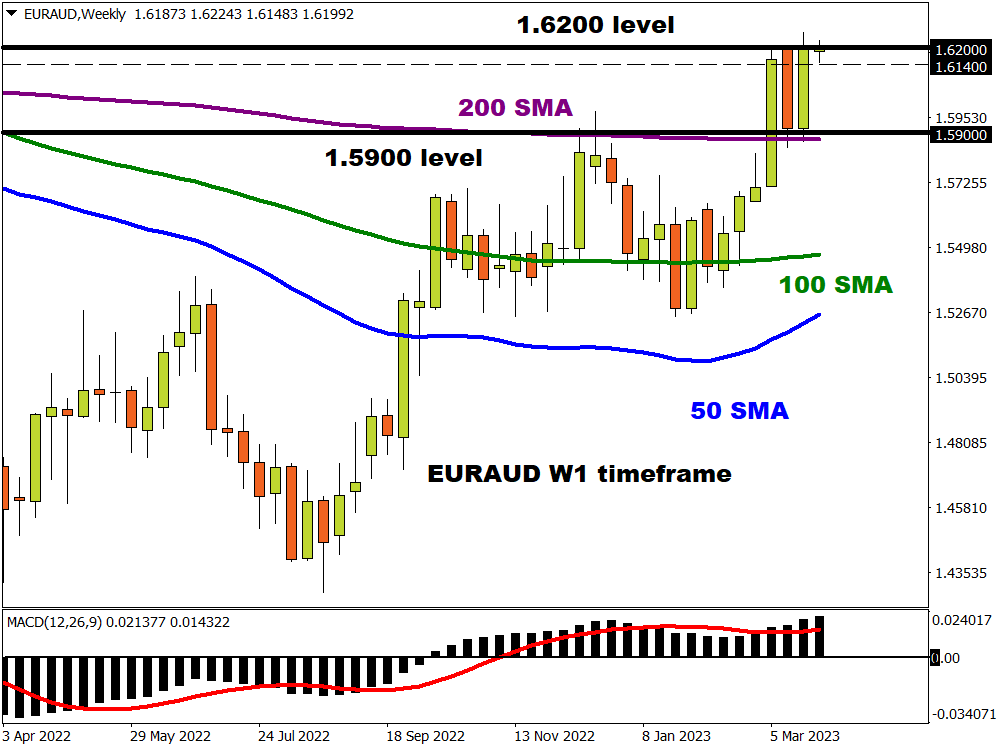

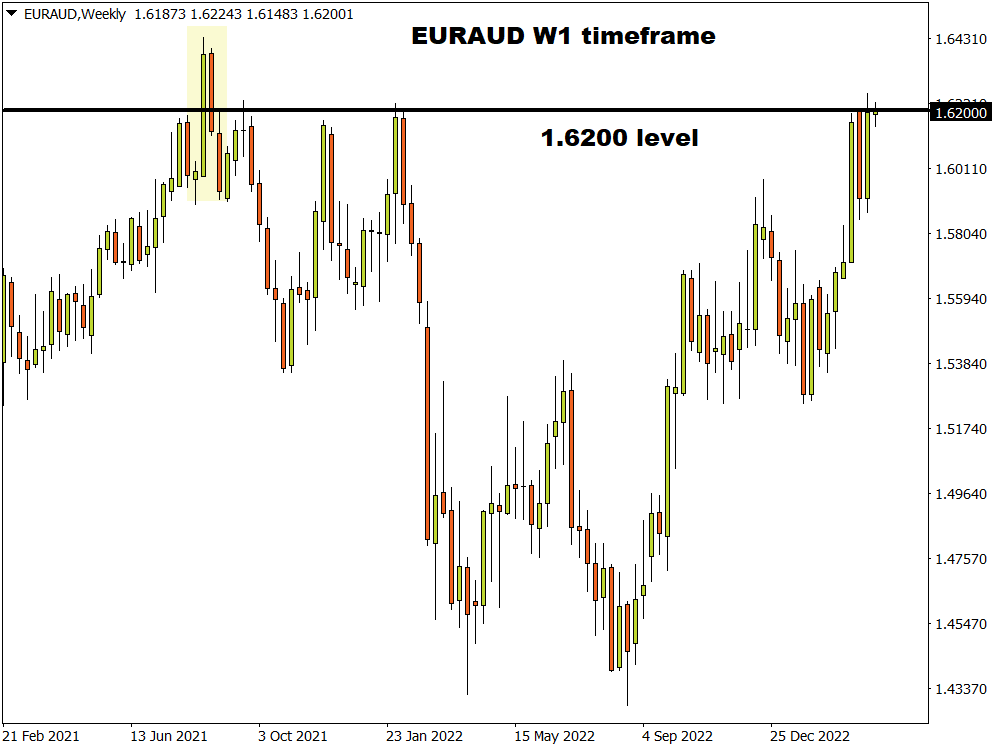

This potent combination of euro strength and aussie weakness reinforced the bullish fundamental view for the EURAUD. Given how prices are also trading well above the 50, 100, and 200-day SMA, the technicals also favour more upside momentum. However, the key question is whether bulls have enough strength to conquer the weekly resistance at 1.6200. It is worth keeping in mind that the last time prices secured a weekly close above this point was back in August 2021.

The low down…

It has been an intense month for the EURAUD thanks to central bank meetings, key economic reports, and major risk events.

Earlier this month, the RBA delivered a dovish hike by moving ahead with a 25bp rate increase and signalling a potential pause in its 10-month tightening cycle. One week later, the European Central Bank hiked rates by 50bp, focusing on its fight against inflation despite the chaos revolving around Silicon Valley Bank. As the negative developments concerning the banking sector intensified with Credit Suisse hijacking the headlines, the risk-off sentiment hit appetite for the Australian dollar. Although some stability has returned to markets, lingering fears around the banking sector could keep the Australian dollar depressed. A weaker Aussie is likely to fuel the upside on the EURAUD.

The week ahead…

We could see some increased activity on the AUD and EUR this week due to key economic reports.

Sentiment towards the German economy received a boost on Monday after the Ifo Business Climate indicator increased to 93.3 in March – the highest seen since February 2021. Given how this survey is seen as one of the best indicators for economic growth, it could support the euro in the near term.

Mid-week, the focus will be directed toward Australia’s February CPI report which is expected to show inflation easing to 7.2% from 7.4% in January. Signs of easing inflation pressures may support the argument for the RBA to pause its monetary tightening cycle in its April report. Ultimately, this development has the potential the weaken the Aussie further.

Germany’s latest inflation figures and Eurozone confidence data will be published on Thursday. The preliminary estimates are expected to reveal that inflation cooled to 7.3% in March from 8.7% in February.

The major risk event for the euro may be on Friday due to the Eurozone's February unemployment and March inflation figures. Markets expect the rate of unemployment to remain unchanged at 6.7% in February. In regards to inflation, this is expected to fall sharply in March to 7.1% from 8.5% in the previous month. If the swift decline in inflation becomes reality, it will be interesting to see whether fuels speculation around the ECB pausing rates down the road.

Will EURAUD conquer weekly 1.6200 resistance?

It looks like the EURAUD could be gearing up for a bullish breakout if 1.6200 can be conquered. Although prices are firmly bullish on the daily charts, some consolidation is taking place as bulls and bears wait for a fresh fundamental spark. Minor support can be found at 1.6140 and minor resistance around 1.6250. A solid daily breakout and close above 1.6250 could inject bulls with enough strength to end the week above the key 1.6200 level. Such an outcome may open doors towards 1.6400 and 1.6550.

Alternatively, sustained weakness below 1.6200 could see prices slip back towards 1.6140 and 1.5900 – a level just above the 200-week Simple Moving Average.